Traders' Sentiment

Note: This section contains information in English only.

Pair's Outlook

Traders' Sentiment

Mon, 01 Oct 2012 16:27:26 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"Speculators boosted bets against the dollar in the latest week to the highest in more than a year"

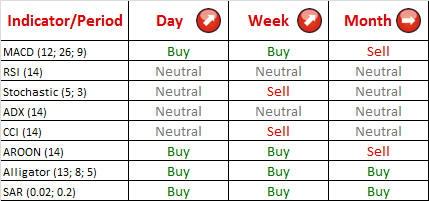

- CNBCThe NZD/USD currency couple keeps moving inside the bullish price channel, and today the currency pair rebounded from the Weekly PP at 0.8270, and now the price is slowly approaching the upper Bollinger band at 0.8366, which is likely to slow down the prevailing tendency. In case it is breached, then next resistance at 0.8448 (Monthly R1) will probably bring some bearish impetus. Additionally, RSI indicator still shows a neutral signal, and it is not expected to change in the nearest future.

Traders' Sentiment

Despite the prevailing uptrend, traders at SWFX market expect the New Zealand Dollar to lose value against the U.S. Dollar, since only 27% of traders hold long positions and almost 73% of traders hold short positions. The situation with orders, however, is quite neutral, as 48% of traders ordered to buy and 52% ordered to sell the kiwi.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.