Traders' Sentiment

Note: This section contains information in English only.

Traders' Sentiment

Fri, 28 Sep 2012 15:02:56 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"The more dovish tone of recent RBA commentaries makes a cut as early as next week quite possible."|

-National Australia Bank (based on The Australian)

Pair's Outlook

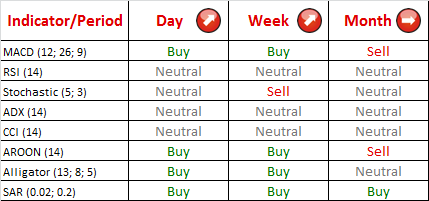

Recent developments allow us to believe that pair is range bound between weekly pivot (S1) at 1.035 and 1.045 and is currently depressed slightly below monthly pivot (PP)/Fibonacci retracement (50% of move since 6th of September) at 1.0404. As technical indicators point at appreciation of the pair it is likely it will bounce of the support levels below.

Traders' Sentiment

USD and AUD, bot remain the most bought major currencies across the board for more than a week now—66% and 59% of all cases respectively. Bullish sentiment remains at 60% gauge today. Distribution of pending orders has not changed as well and 54% of pending orders are to buy.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.