Pair's Outlook

Note: This section contains information in English only.

Pair's Outlook

Mon, 17 Sep 2012 15:20:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"It's a new week and markets remain firmly gripped by post (Federal Open Market Committee) fever. Risk assets are performing well again and safer bonds are under heavy selling pressure."

-Commonwealth Bank (based on The Australian)

Pair's Outlook

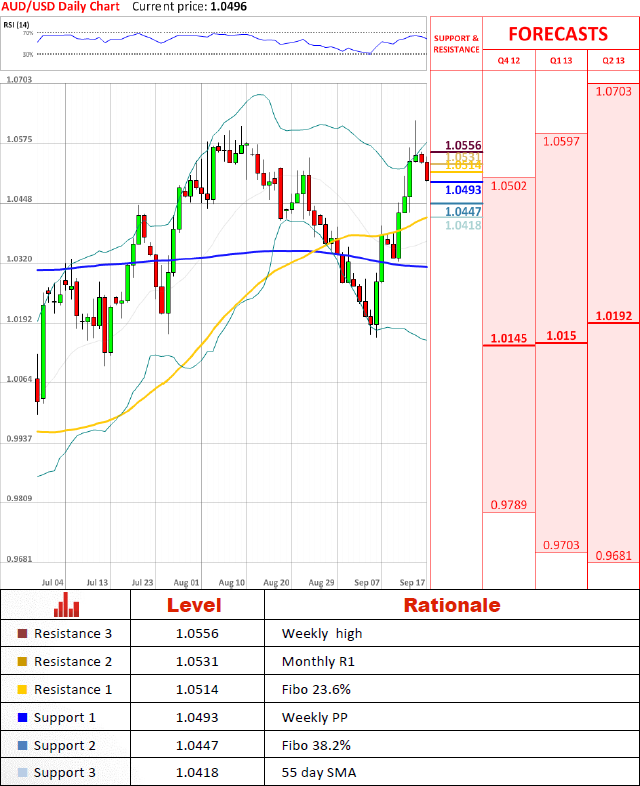

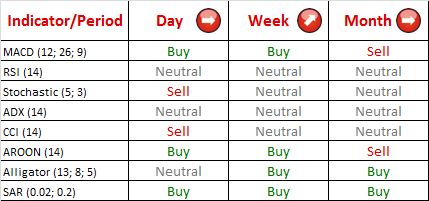

Driven by momentum pair tried to breach summer high at 1.0612, but was firmly pushed back and is currently testing weekly pivot (PP) at 1.0493. Most likely pair will demonstrate bearish correction for few more days and stabilize before continuing to appreciate.

Although 15% more traders started to hold long positions on the pair after the weekend and bearish sentiment persists as 53% of traders hold short positions on the pair. However, 54% of all pending orders on the pair are buy orders suggesting that sentiment might switch again in the near future.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.