Traders' Sentiment

Note: This section contains information in English only.

"If the yen rises on Monday, when Japanese markets are closed for a national holiday, the BOJ may loosen policy in tandem with currency intervention by the government."

"If the yen rises on Monday, when Japanese markets are closed for a national holiday, the BOJ may loosen policy in tandem with currency intervention by the government."

Traders' Sentiment

Fri, 14 Sep 2012 15:19:51 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

-Dai-Ichi Life Research Institute (based on Reuters)

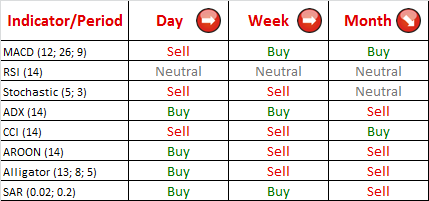

Pair's Outlook

Pairs return below 100 was short-lived and it appreciated frantically today after breaching uptrend resistance at 101.021. Currently pair is slowed down by Fibonacci (50% of move since 21st of March) at 102.765. Further appreciation of the pair in medium and long term is very likely, as there are no stronger resistance levels on the way up, and cluster of support levels around 102 should maintain the pair above this level. In the short term we are almost certain to see bearish correction.

Traders' Sentiment

Bearish sentiment on the pair strengthened by 4% since yesterday and is at 57% mark. However, 80% of all pending orders on the pair are buy orders suggesting that we might see a major shift in the sentiment and bullish rally on the pair. In the near future.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.