Traders' Sentiment

Note: This section contains information in English only.

"Markets are quiet with a slight bias to shed risk. Paralysis ahead of Jackson Hole and extreme event risk in early September are the key themes"

"Markets are quiet with a slight bias to shed risk. Paralysis ahead of Jackson Hole and extreme event risk in early September are the key themes"

Traders' Sentiment

Thu, 30 Aug 2012 06:47:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Scotia Capital (based on CNBC)

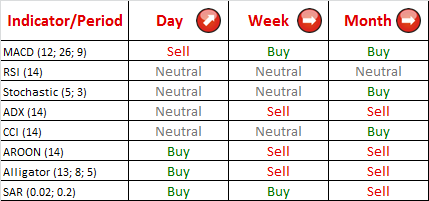

Pair's Outlook

Being that EUR/USD has approached a major downtrend resistance line and 23.60% Fibo retracement level for a move started on October 27 last year, September promises to be bearish for the currency couple, as recent short squeezing is unlikely to develop into a self-sufficient long-term rally. Moreover, the pair is forming a rising wedge, which is considered to be a bearish formation.

Traders' Sentiment

SWFX marketplace traders' sentiment towards EUR/USD is unchanged, since 40% of positions held are long and 60% of them are short, thus providing less support to the Euro than for the U.S. Dollar. However, orders placed on the pair are mostly (57%) to buy the 17-nation currency against the greenback.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.