Traders' Sentiment

Note: This section contains information in English only.

"Given mixed economic indicators of late, I doubt the Fed will embark on QE3 in September. If the Fed just extends the period of low rates, the impact on the currencies will be limited"

"Given mixed economic indicators of late, I doubt the Fed will embark on QE3 in September. If the Fed just extends the period of low rates, the impact on the currencies will be limited"

Traders' Sentiment

Thu, 23 Aug 2012 06:41:46 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Makoto Noji, SMBC Nikko Securities (based on CNBC)

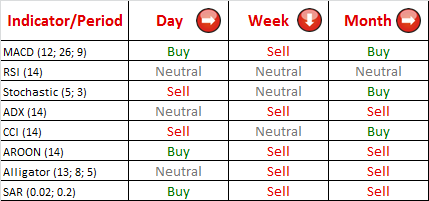

Pair's Outlook

EUR/USD continuously refuses to submit to a bearish outlook and has broken yet another resistance (1.2513/30), which was supposed to contain the current rally of the pair. Now the currency couple faces a combination of two downtrend resistance lines that will attempt to halt the advancement once the price comes into a range between 1.2576/1.2633.

Traders' Sentiment

The share of long positions on EUR/USD has declined once again, as bullish traders presently constitute 44% of the market, while bears continue to enlarge their advantage and already form 56% of the market. On the other hand, the ratio between buy and sell orders placed on the currency pair is one-to-one.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.