Traders' Sentiment

Note: This section contains information in English only.

Traders' Sentiment

Tue, 21 Aug 2012 14:54:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"The market was looking for a fair bit more commentary on the Aussie dollar itself following the monetary policy statement a week and a half ago as well as the statement accompanying the policy decision where the RBA seemed to ramp up its rhetoric about the currency."

-David Forrester, Macquirie Bank (based on Bloomberg)

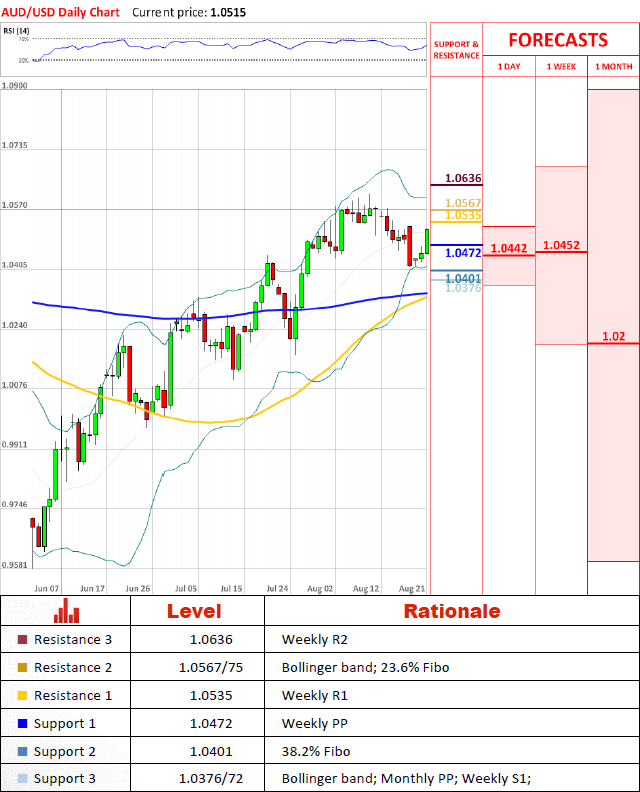

Pair's Outlook

Pair has returned to levels prior to sharp drop at the end of last week and should continue developing normally further. Weekly R1 should not allow the pair to appreciate further for some time now and contain in 1.0472/1.0535 range.

Traders' Sentiment

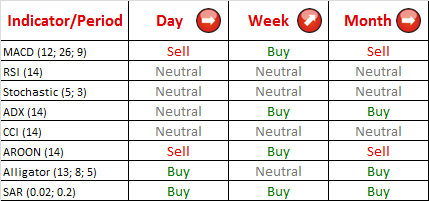

Bearish sentiment remains at 74% mark after increasing by 5% after the weekend. The distribution of pending orders shifted from 59% of buy orders to 67% of sell orders since yesterday suggesting a further strengthening of bearish sentiment.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.