Traders' Sentiment

Note: This section contains information in English only.

"The U.S. economy is growing slowly, and I view that as a positive. The expansion is at a sufficient pace for the Fed to hold fire. This lends support to the dollar"

"The U.S. economy is growing slowly, and I view that as a positive. The expansion is at a sufficient pace for the Fed to hold fire. This lends support to the dollar"

Traders' Sentiment

Wed, 15 Aug 2012 07:10:38 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Hans Kunnen, St. George Bank Ltd. (based on Bloomberg)

Pair's Outlook

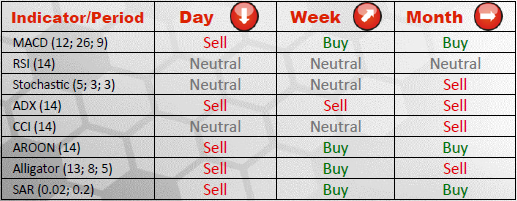

USD/CHF hangs above 0.9750/38, while its dips should be also contained by support at 0.9702/0.9691, which proved to be strong enough to negate bearish momentum when the pair tried to complete a head and shoulders pattern just recently. Accordingly, we expect the price to stay between 0.9770 and 0.9750/38 for now, even though indicators point to the downside.

Traders' Sentiment

Traders' sentiment is unchanged towards USD/CHF. An overwhelming majority of traders (73%) foresee appreciation of the greenback relatively to the Swiss Franc, as the latter currency is among the least popular currencies in SWFX market. On the other hand, buy orders are in minority (46%).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.