Traders' Sentiment

Note: This section contains information in English only.

"Everybody's waiting to hear what the Federal Reserve does. If you get continually weak prints out of certain economic data points, it's going to weaken the dollar"

"Everybody's waiting to hear what the Federal Reserve does. If you get continually weak prints out of certain economic data points, it's going to weaken the dollar"

Traders' Sentiment

Tue, 14 Aug 2012 07:36:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Scotiabank (based on Bloomberg)

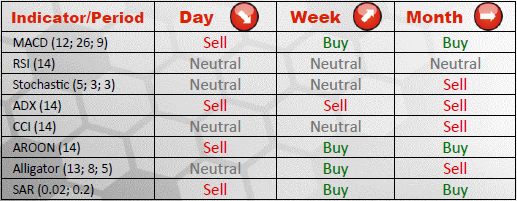

Pair's Outlook

The price slipped after encountering a 20 day SMA and is trying to erode an uptrend support, violation of which will expose 0.9627/0.9598 and 0.9553/39 in the short-term and 0.9381/60 in the long run. However, the currency pair is still viewed as capable of negating current bearish bias and remaining within an upward channel, which directed behaviour of pair since the beginning of May.

Traders' Sentiment

The pair is overbought to a substantial extent, as 74% of positions opened are long and only 26% of them are short. Consequently, the general expectation of the market is appreciation of the greenback. However, given that most of orders (60%) are to sell the USD, further advancement of the price is under question.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.