Traders' Sentiment

Note: This section contains information in English only.

"A strong gain for U.S. retail would add to the muddied water in terms of whether the Federal Reserve will embark on another round of quantitative easing in September"

"A strong gain for U.S. retail would add to the muddied water in terms of whether the Federal Reserve will embark on another round of quantitative easing in September"

Traders' Sentiment

Mon, 13 Aug 2012 07:26:37 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- RBC Capital Markets (based on MarketWatch)

Pair's Outlook

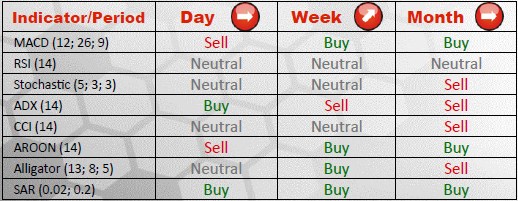

USD/CHF stopped at 0.9787, but should be able to recommence advancement and soon attain 0.9842 while moving en route to 0.9994/1.0003 in a longer time perspective. Even though indicators do not give a distinct "buy" signal, the currency pair is deemed to be bullish, since it is underpinned by support at 0.9750/38, which is formed by an impenetrable until now uptrend support.

Traders' Sentiment

The Swiss Franc is the least popular currency at the moment, being bought only in 25% of transactions. Accordingly, stance of traders towards USD/CHF is extensively bullish, being that long positions constitute 74% of the market. As for the orders, only 39% support further advancement of the pair, while 61% of them are sell orders and will hamper appreciation of the USD.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.