Traders' Sentiment

Note: This section contains information in English only.

"Overall, the markets are willing to give the ECB the benefit of the doubt. The ECB is out there saying it will do something and that in itself is a positive"

"Overall, the markets are willing to give the ECB the benefit of the doubt. The ECB is out there saying it will do something and that in itself is a positive"

Traders' Sentiment

Mon, 13 Aug 2012 07:11:20 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- AFEX Markets Plc (based on CNBC)

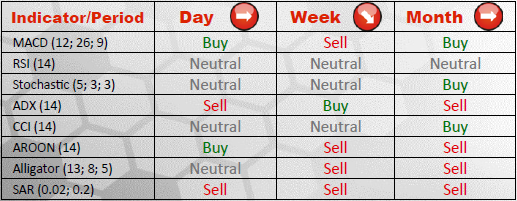

Pair's Outlook

Currently EUR/USD is attempting to bounce from an accelerated uptrend support at 1.2271, but the rally should to be shallow, given that medium and long-term outlooks remain bearish. An initial resistance lies at 1.2319/37 and is likely to halt advancement in conjunction with the following resistance at 1.2385/96 (55 day SMA).

Traders' Sentiment

Despite the Euro being the most frequently acquired currency in SWFX marketplace (in 66% of cases), traders' sentiment remains neutral particularly towards EUR/USD, as 51% of traders are bullish and 49% are bearish on the pair. Orders, on the other hand, reveal much more negative sentiment, since 59% of them are to sell the common currency.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.