Note: This section contains information in English only.

Fri, 10 Aug 2012 15:49:34 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"We have seen quite a shift in monetary policy expectations. Hit by the double employment whammy yesterday it has hardened expectations that the Reserve Bank is on hold for the foreseeable future, dragging the kiwi off its highs."

- Mike Jones, Bank of New Zealand (based on NZ Herald)

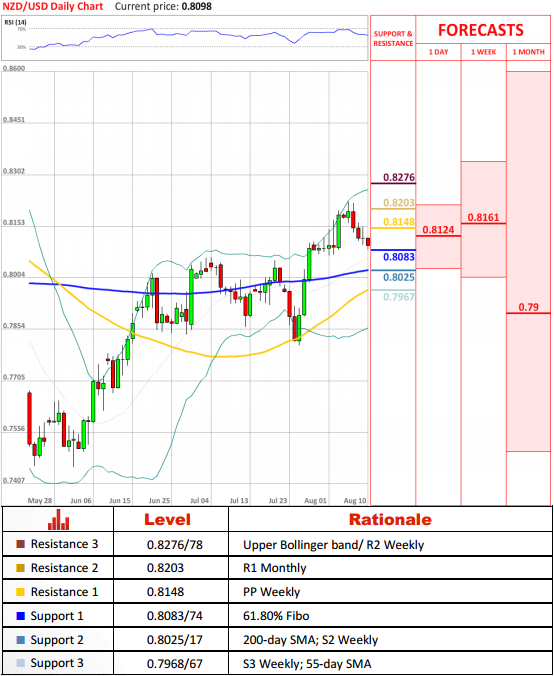

Pair kept depreciating today, but was unable to breach level of 0.8083. Although outlook of the pair remains mildly positive for short and medium term, but pair is bound to meet heave resistance once it approaches 0.8148 (PP Weekly) and should resume falling towards 0.8025 (200-day SMA).

Traders' SentimentCurrent market sentiment remains only slightly in favor for the short traders at the moment. However, in the range of 100 pips from the current price, number of sell order is twice bigger than number of buy orders suggesting a possible major increase in favoritism for short selling.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.