Note: This section contains information in English only.

Fri, 10 Aug 2012 15:49:21 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"Now the market will begin to look forward to and anticipate what will be said at the Jackson Hole conference at the end of August and then what the FOMC may or may not decide at its September meeting."

- Tom Kendall, Credit Suisse (based on CNBC)

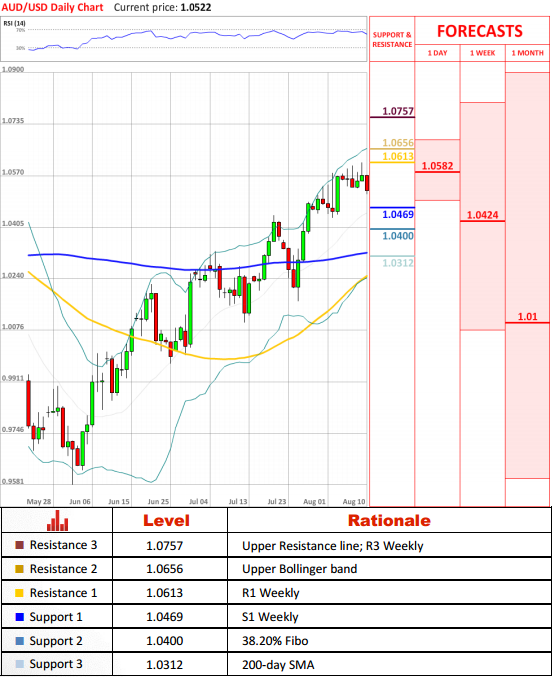

The Aussie dollar took a plunge against the US dollar and right it is likely to keep bearish momentum over the short run. If this is the case, 1.0469 (S1 Weekly) is going to be an initial support line for investors, followed by 1.0400 (38.20% Fibo) and 1.0312 (200-day SMA) once bearish momentum strengthens.

Traders' SentimentThe stance on AUD/USD is bearish at the present as 61% of investors keep short positions and 39% of market participants hold long positions on the pair. Meanwhile, the order disposition shows that 52% of investors stick to a bullish outlook on the Aussie Dollar -US Dollar currency pair.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.