Note: This section contains information in English only.

"There's plenty of doom and gloom on the growth front pushing the euro lower. Part of it can be explained by the firmer tone in the dollar, partly due to China. The euro is on the back foot."

"There's plenty of doom and gloom on the growth front pushing the euro lower. Part of it can be explained by the firmer tone in the dollar, partly due to China. The euro is on the back foot."

Fri, 10 Aug 2012 15:49:15 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Jane Foley, Rabobank International (based on Bloomberg)

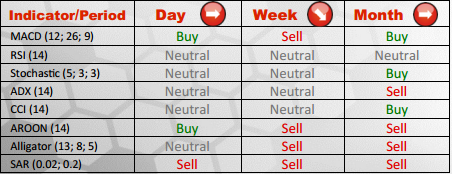

The shared European currency slipped lower against Japan's Yen, deepening a bearish correction on EUR/JPY. If bearish momentum to go on, 96.18 (Upper Support line) might become an initial support level for bearish traders. A breakout of this line would expose 95.14 (Lower Support line) and 92.93 (S2 Weekly), respectively.

Traders' SentimentTraders' sentiment remains bullish on EUR/JPY today, though it slightly weakened compared to yesterday as 65% of market participants are presently long on the currency pair and 35% of traders still expect the pair to decline further. The allocation of long and short positions points at a weakening bullish sentiment as 54% of investors expect the pair to advance over the middle term.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.