Traders' Sentiment

Note: This section contains information in English only.

"The euro is working its way through another small corrective phase within a massive, long-term downshift"

"The euro is working its way through another small corrective phase within a massive, long-term downshift"

Traders' Sentiment

Fri, 10 Aug 2012 06:40:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Global Hunter Securities (based on CNBC)

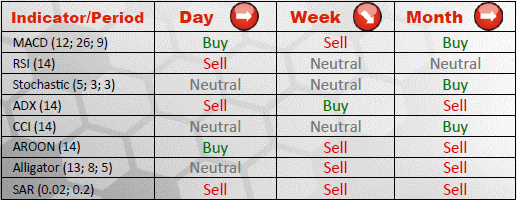

Pair's Outlook

Advancement of EUR/USD did not extend beyond a 55 day SMA, which has been retaining the pair in a downtrend for more than three months. An initial support zone at 1.2264/26 is unlikely to withstand bearish pressure for long, eventually giving way for a deeper dip, to 1.2061/1.1996. The nearest resistance, on the other hand, may be found at 1.2334/34.

Traders' Sentiment

SWFX traders' sentiment is perfectly neutral towards EUR/USD, as both long and short positions constitute equal shares in the market, even though the Euro is more frequently acquired currency than the U.S. Dollar. On the other hand, orders reveal propensity of traders to place sell orders on the pair, the portion of which is 56% at the moment of the total amount.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.