Traders' Sentiment

Note: This section contains information in English only.

"Risk markets are at very key levels of resistance at the moment and if they can be hurdled, then that would be evidence of the market's good sentiment for riskier assets"

"Risk markets are at very key levels of resistance at the moment and if they can be hurdled, then that would be evidence of the market's good sentiment for riskier assets"

Traders' Sentiment

Mon, 06 Aug 2012 07:04:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Rochford Capital (based on Bloomberg)

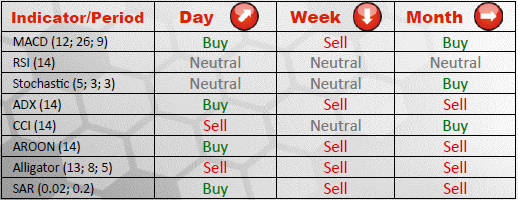

Pair's Outlook

EUR/USD still preserves some bullish momentum since Friday, as suggested by technical indicators on a daily timeframe. However, it is expected to wane afterwards, since resistance at 1.2410/40 is already proving the present rally of the pair to be fragile. Further appreciation of the Euro will encounter levels at 1.2535 and 1.2633/44, while dips will be limited by supports at 1.2337/34 and 1.2252/26.

Traders' Sentiment

Being that the shares of long and short positions are nearly equal, 49% to 51%, respectively, sentiment of traders towards EUR/USD remains mixed, while popularities of the Euro and U.S. Dollar are the same, since these currencies are both being bought in 58% of cases.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.