Note: This section contains information in English only.

Mon, 30 Jul 2012 07:27:53 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"If we get to the September meeting and the Fed, looking at the latest data, sees the economy running at less than a 2 pct GDP pace, they're likely to act"

- PNC (based on Reuters)

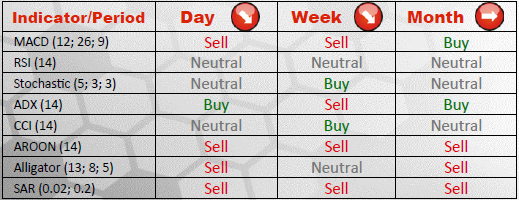

Bullish correction of USD/JPY has been terminated ahead of resistance at 78.80, leading to a possible breach of an interim support level at 78.37 and increased possibility of 78.08/06 being attained in the short-term, since both daily and weekly indicators give sell signals. Additional supports may be found at 77.83 and 77.66/63, but should remain intact for now.

Traders' SentimentAn overwhelming majority of market participants (75%) have preferred to acquire the greenback against the Japanese Yen, which in turn is the second least popular currency in SWFX marketplace after swissie. The portion of buy orders, on the other hand, has fallen dramatically - down to 54%, thus allowing sell orders to constitute 46% of the total amount.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.