Traders' Sentiment

Note: This section contains information in English only.

"We are unlikely to see any material change in ECB policy beyond a final cut to the [benchmark] refi rate which we think will happen in September"

"We are unlikely to see any material change in ECB policy beyond a final cut to the [benchmark] refi rate which we think will happen in September"

Traders' Sentiment

Fri, 27 Jul 2012 06:47:37 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Royal Bank of Canada (based on MarketWatch)

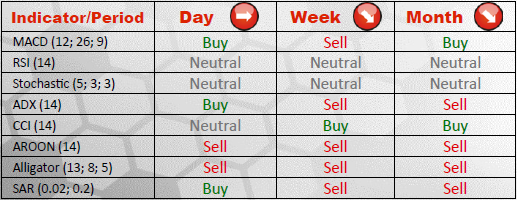

Pair's Outlook

Neither 1.2187 nor 1.2236/62 managed to halt the currency pair and thus exposed a subsequent key area at 1.2386/1.2474. The latter resistance is highly unlikely to be violated, given that it is a confluence of several resistances, including 55 day SMA and monthly S1. Accordingly, our favoured scenario is a rebound from this zone and revitalisation of bearish activity.

Traders' Sentiment

Even though the Euro remains the most popular currency in SWFX marketplace (being acquired in 72% of cases), the share of long positions on EUR/USD is declining and has already reached 57%. The ratio between buy and sell orders is 53 to 47 per cent, respectively.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.