Traders' Sentiment

Note: This section contains information in English only.

"Both the Moody's action and the Spanish woes have been known for months, so with the market so short euros, there's a chance of a short-covering bout in the euro"

"Both the Moody's action and the Spanish woes have been known for months, so with the market so short euros, there's a chance of a short-covering bout in the euro"

Traders' Sentiment

Wed, 25 Jul 2012 07:08:35 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Tokyo-Mitsubishi UFJ (based on CNBC)

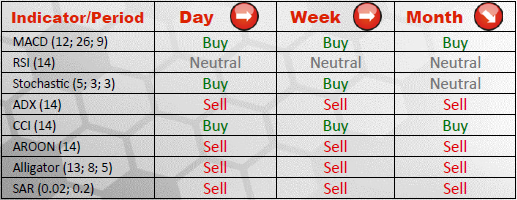

Pair's Outlook

EUR/USD slipped down to 1.2051 and is currently stabilising before recommencing movement towards 1.2002/1.1976, where the pair might attempt to reverse medium-term tendency, while long-term outlook, nonetheless, should remain bearish. Rally then is likely to encounter resistances at 1.2106 and 1.2187 and possibly could extend even higher.

Traders' Sentiment

The share of bullish market participants remains at 60%, accordingly, bearish traders constitute 40% of the market, indicating elevated conviction of the market the Euro is to appreciate relatively to the greenback. However, the ratio between buy and sell orders is 41% to 59%, respectively.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.