Traders' Sentiment

Note: This section contains information in English only.

"The [dollar's] steady grind lower extended through the North American session, and in the absence of any market moving data/news, similar price action was seen in Asia"

"The [dollar's] steady grind lower extended through the North American session, and in the absence of any market moving data/news, similar price action was seen in Asia"

Traders' Sentiment

Thu, 19 Jul 2012 08:20:56 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Royal Bank of Canada (based on MarketWatch)

Pair's Outlook

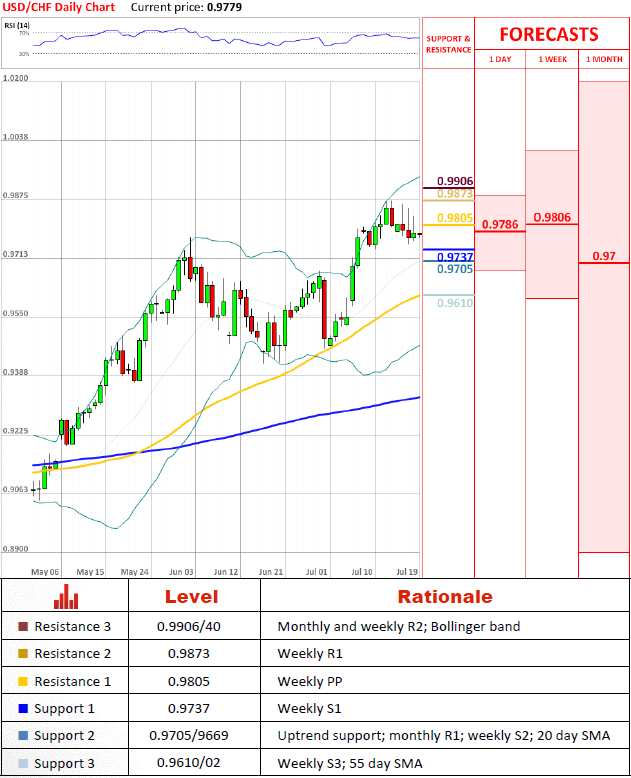

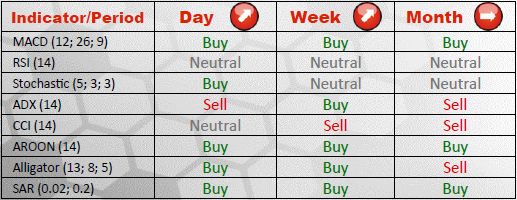

Level at 0.9805 proved to be resilient by forbidding USD/CHF to rally far above it for the last three days. Still, we stick to out view that the pair is bullish in the medium to long term, given that majority of technical indicators give "buy" signals for daily and weekly timeframes at the moment. Nonetheless, USD/CHF may drop down to 0.9737 and 0.9705/69 in the short run.

Traders' Sentiment

Portion of bulls is gradually diminishing and has already dropped to 58%, thus increasing the chance of SWFX sentiment index becoming mixed, while there is growing number of traders, who anticipate appreciation of the Swissie relative to the U.S. Dollar. The share of buy orders, on the other hand, is 42%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.