Traders' Sentiment

Note: This section contains information in English only.

"Chairman Bernanke is not likely to give an indication that further easing is imminent. That added to negative earnings surprises in the U.S. may weigh on risk sentiment in the near term, boosting the USD more broadly"

"Chairman Bernanke is not likely to give an indication that further easing is imminent. That added to negative earnings surprises in the U.S. may weigh on risk sentiment in the near term, boosting the USD more broadly"

Traders' Sentiment

Tue, 17 Jul 2012 07:52:22 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Barclays (based on MarketWatch)

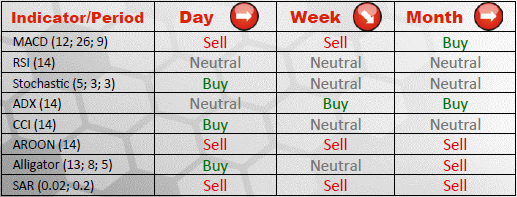

Pair's Outlook

At the moment we observe a small rebound of USD/JPY from 78.88/85, which is unlikely to extend further, being that overall technical studies are neutral. The currency pair is thus expected to consolidate near the support for now, until a more pronounced signal appears. In case the price commences strong recovery, it will face a confluence of many resistances at 79.35/49, which is now viewed as impenetrable and will take time to be eroded.

Traders' Sentiment

The share of bullish traders has grown up to 71% since yesterday, signifying increasing conviction of market participants the greenback is going to appreciate relative to the Yen. At the same time bearish camp is not replenished with new members and currently forms 29% of the market. Distribution of orders is quite similar, 73% to 27% of buy and sell orders, respectively.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.