Traders' Sentiment

Note: This section contains information in English only.

"There were no additional indications for the course of future Federal Reserve policy in the minutes of last month's FOMC meeting"

"There were no additional indications for the course of future Federal Reserve policy in the minutes of last month's FOMC meeting"

Traders' Sentiment

Thu, 12 Jul 2012 07:19:45 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Worldwide Markets (based on CNBC)

Pair's Outlook

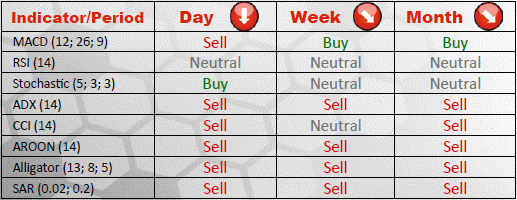

The currency pair continues to drift lower and is likely to gain more bearish momentum in near future, as more indicators give "sell" signals, especially for a daily timeframe. The initial formidable support EUR/USD may bump into lies at 1.2128/06, below which the pair will be able to encounter 1.1986/26, where a bullish correction is probably going to be commenced.

Traders' Sentiment

The share of bullish towards EUR/USD market participants is gradually growing and has already reached 68% of the market. Accordingly, the portion of bears is going down, being 32% at the moment, since the Euro is the most frequently acquired currency in SWFX marketplace (in 71% of cases). The ratio between buy and sell orders, on the other hand, is 46% to 54%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.