Traders' Sentiment

Note: This section contains information in English only.

"The markets are extremely jittery and are willing to react negatively to any sign that the European authorities are unwilling to work together to save the euro zone"

"The markets are extremely jittery and are willing to react negatively to any sign that the European authorities are unwilling to work together to save the euro zone"

Traders' Sentiment

Wed, 11 Jul 2012 06:59:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Forex.com (based on MarketWatch)

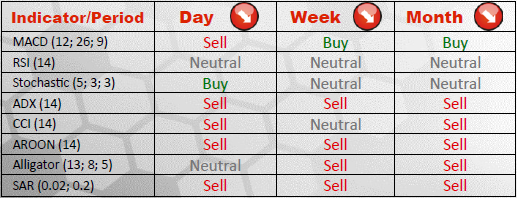

Pair's Outlook

EUR/USD has temporarily stopped near yesterday's support at 1.2240, but should continue sliding downwards, as suggested by most of indicators for all three time frames. The closest support at the moment lies at 1.2200 and guards subsequent levels at 1.2128/06 and 1.1986/26, where we are likely to see a more pronounced rebound.

Traders' Sentiment

Step by step the portion of long positions on EUR/USD is increasing, already reaching 62% of the market. Short positions are in distinct minority, as the Euro is the most popular currency at the moment, being acquired in 74% of cases. Buy orders, on the other hand, constitute only 41% of the total amount, implying that most of market participants do expect a rally, but a rather shallow one.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.