Traders' Sentiment

Note: This section contains information in English only.

"Traders expect the ECB to move to bolster the region's economy by cutting its main refinancing rate by 25 basis points to 0.75 percent at its policy meeting on Thursday"

"Traders expect the ECB to move to bolster the region's economy by cutting its main refinancing rate by 25 basis points to 0.75 percent at its policy meeting on Thursday"

Traders' Sentiment

Tue, 03 Jul 2012 07:09:55 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- CNBC

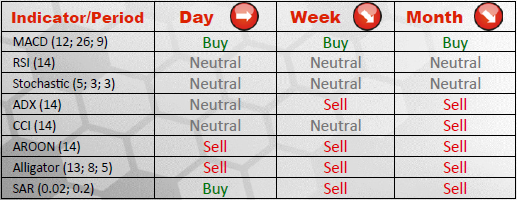

Pair's Outlook

EUR/USD was unable to sustain Friday's rally due to an encounter with a tough resistance located at 1.2671/84. This has lead to a pullback to a support at 1.2587/73, which may trigger some temporary short-squeezing, but is expected to be soon eroded nevertheless. Additional levels are to be found at 1.2483 and 1.2418/1.2399, since the overall outlook remains bearish.

Traders' Sentiment

SWFX traders' sentiment towards EUR/USD remains neutral, as the ratio between long and short positions is 51% to 49%, regardless of the common currency being the most popular among its major counterparts. The situation with orders placed on the pair is very much alike, as 49% of them are buy orders and 51% are sell orders, signifying current indecision of market participants.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.