Traders' Sentiment

Note: This section contains information in English only.

"An undramatic summit result could be a catalyst for speculative accounts to reset short positions in the euro and growth-sensitive currencies. We remain bullish on the U.S. dollar heading into this week's events "

"An undramatic summit result could be a catalyst for speculative accounts to reset short positions in the euro and growth-sensitive currencies. We remain bullish on the U.S. dollar heading into this week's events "

Traders' Sentiment

Tue, 26 Jun 2012 07:11:45 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Credit Suisse (based on CNBC)

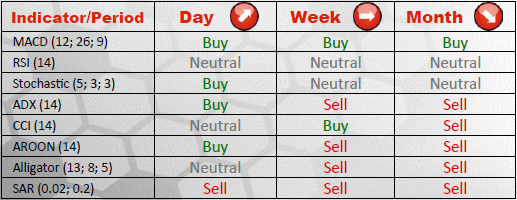

Pair's Outlook

EUR/USD is being continuously sold off and is currently approaching an initial support level at 1.2456/32. In case this area does not withstand bearish pressure, bearish move may extend down to 1.2375 while en route to a long-term target situated at 1.2037. Rallies, on the other hand, should be limited be resistances at 1.2571/99 and at 1.2660/80.

Traders' Sentiment

Sentiment of market participants remains mixed towards EUR/USD, as 56% of positions are long and 44% of them are short, even though the single European currency is the most popular among its major counterparts. As for the orders, 42% of them are to buy the Euro and 58% are to sell it against the U.S. Dollar.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.