© Dukascopy

"If there was a downgrade of the U.S. credit rating, the dollar would be sold off. But that seems unlikely in the very near future"

- Tokai Tokyo Securities (based on Reuters)

Industry outlook

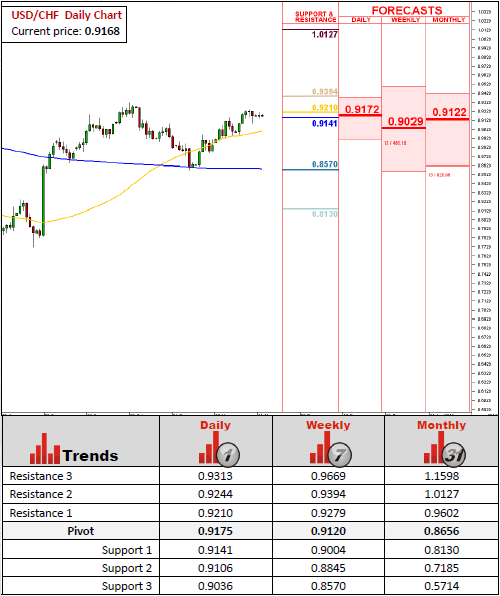

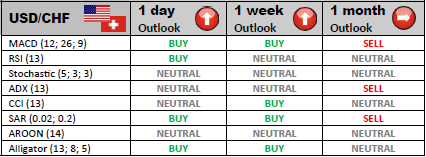

Trading indicators show a strong sell signal for USD/CHF, even though dips will encounter tough supports at 0.9015 and 0.8555/20 that should hold the pressure. Nevertheless the outlook remains positive with aims set at 0.9237, 0.9317 and eventually 0.9341.

Traders' sentiment

It seems that overbought signal is gradually losing its significance, as step by step traders are turning to the other side, expanding the portion of shorts in the market, which currently are 32.29%, longs, on the other hand, are 67.71%.

Long position opened

Investors are suggested to pay close attention to the identified resistance levels for the pair at 0.9210, 0.9244 and 0.9313.

Short position opened

Major market participants with short positions will hold their deals until the price slides down to the initial support level at 0.9141. If the price continues the downtrend, the dealers might wait for the price to depreciate down to 0.9106 or 0.9036.

© Dukascopy