Note: This section contains information in English only.

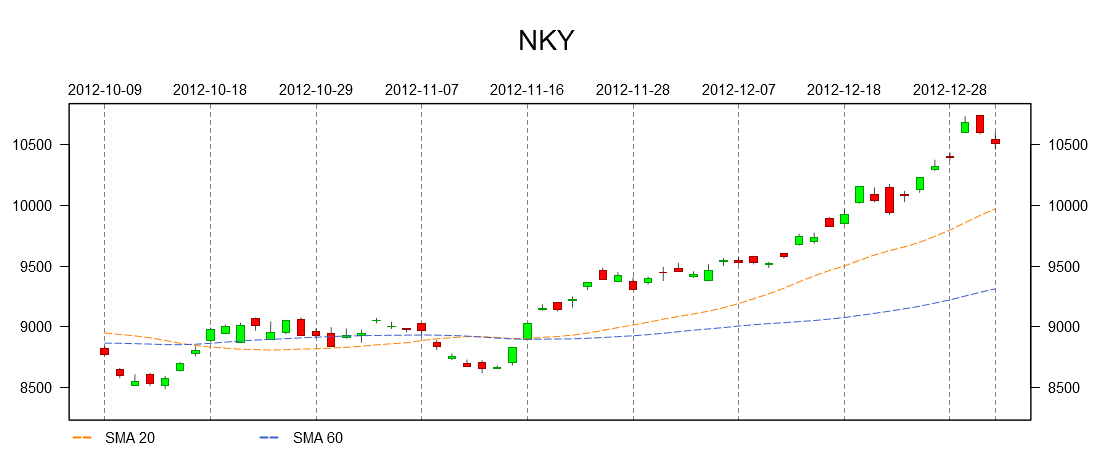

Japanese equities extended their gains for a third consecutive day after the Japanese government announced a stimulus package of 3.8 trillion yen to recover the nation's economy from recession and 3.1 trillion yen ti boost up investment. In addition, exporters advanced on weakening Yen. The Nikkei 225 rose 1.4% to 10,801.57, gaining 1.1% throughout the week. Sharp Corporation rallied the most by 12.6%, leading gains in the technology sector that was 1.83% up. Astellas Pharma Inc soared 7.41%, a pharmaceutical company, paced an increase in the Health Care sector that surged 3.2%. Yokogawa Electric Corporation halted a further decline in the utilities shares and added 6.7%. Meanwhile Toray Industries lost 3.47%, bounding further gains in the basic materials sector that was 0.83% up, while Fujikura erased 2.14% to 275 yen. Furthermore, Sumitomo Osaka Cement Co also capped gains in the basic materials shares by slipping 1.9%.

Japanese equities extended their gains for a third consecutive day after the Japanese government announced a stimulus package of 3.8 trillion yen to recover the nation's economy from recession and 3.1 trillion yen ti boost up investment. In addition, exporters advanced on weakening Yen. The Nikkei 225 rose 1.4% to 10,801.57, gaining 1.1% throughout the week. Sharp Corporation rallied the most by 12.6%, leading gains in the technology sector that was 1.83% up. Astellas Pharma Inc soared 7.41%, a pharmaceutical company, paced an increase in the Health Care sector that surged 3.2%. Yokogawa Electric Corporation halted a further decline in the utilities shares and added 6.7%. Meanwhile Toray Industries lost 3.47%, bounding further gains in the basic materials sector that was 0.83% up, while Fujikura erased 2.14% to 275 yen. Furthermore, Sumitomo Osaka Cement Co also capped gains in the basic materials shares by slipping 1.9%.

Fri, 11 Jan 2013 18:26:03 GMT

Source: Dukascopy Bank SA, Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.