Note: This section contains information in English only.

German shares dropped on falling exports from the largest economy in Europe and declined factory orders. In addition, investors also held back, waiting for the fourth-quarter earnings session in the U.S. The DAX index declined 0.4% to 7,705.14. The index has still advanced 1.2% this year. Telecommunications and health care were the only sectors advancing in the gauge by 0.7% and 1%, respectively. Beiersdorf, the Nivea skin cream maker, advanced 2.7% to 62.50 euros after Homura Holdings increased the price target for Beiersdorf from 60 euros to 70 euros, capping losses in the consumer goods sector. Meanwhile, Lanxess led basic materials lower by dropping 3%, followed by Bayerischen Motoren Werke that erased 2.9%. Furthermore, Munich Re slipped 1.8% after Merrill Lynch unit at Bank of America downgraded its rating from neutral to underperform. The biggest re-insurer in the world trigerred a 0.25 % decline in the financials sector.

German shares dropped on falling exports from the largest economy in Europe and declined factory orders. In addition, investors also held back, waiting for the fourth-quarter earnings session in the U.S. The DAX index declined 0.4% to 7,705.14. The index has still advanced 1.2% this year. Telecommunications and health care were the only sectors advancing in the gauge by 0.7% and 1%, respectively. Beiersdorf, the Nivea skin cream maker, advanced 2.7% to 62.50 euros after Homura Holdings increased the price target for Beiersdorf from 60 euros to 70 euros, capping losses in the consumer goods sector. Meanwhile, Lanxess led basic materials lower by dropping 3%, followed by Bayerischen Motoren Werke that erased 2.9%. Furthermore, Munich Re slipped 1.8% after Merrill Lynch unit at Bank of America downgraded its rating from neutral to underperform. The biggest re-insurer in the world trigerred a 0.25 % decline in the financials sector.

Tue, 08 Jan 2013 18:29:03 GMT

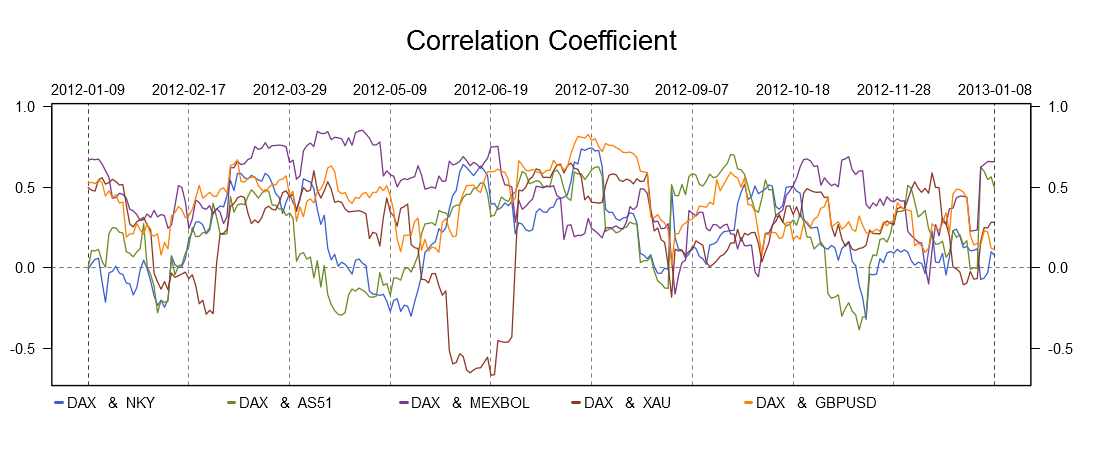

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.