Choisissez parmi 7 classes d'actifs et accédez à plus de1200 instruments de trading

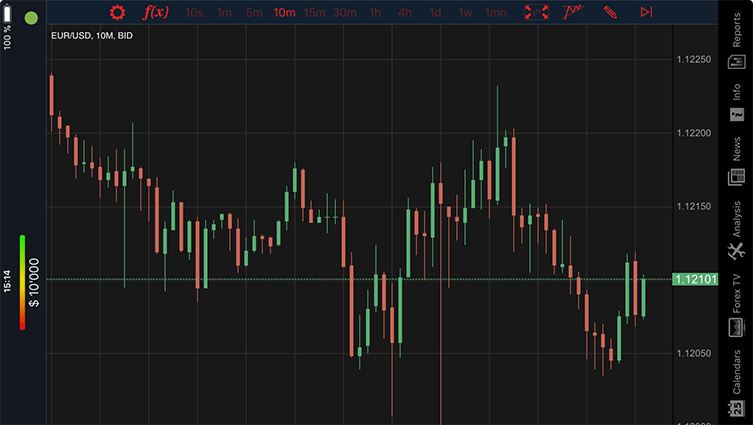

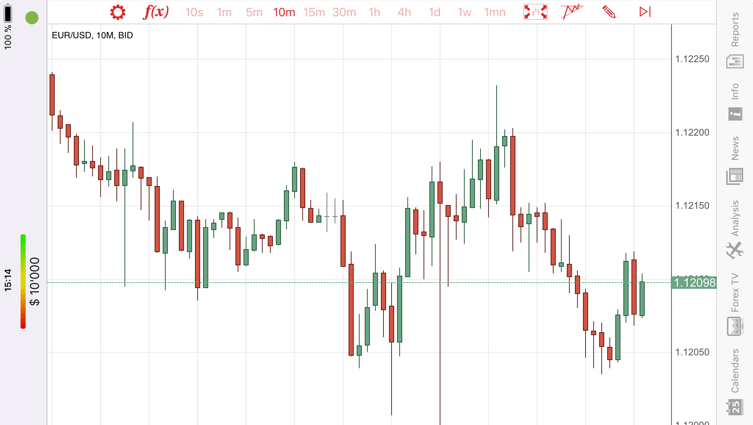

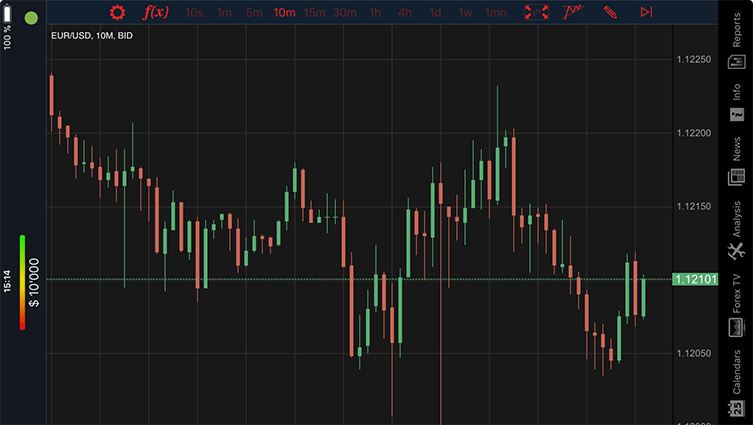

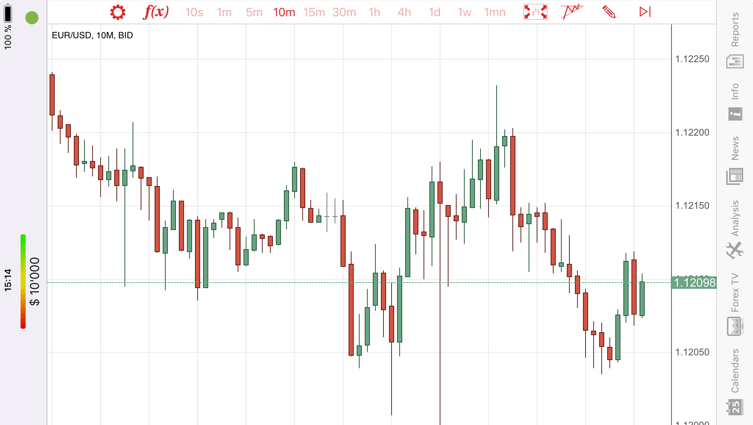

Consultez l'historique du meilleur mouvement de prix BID / ASK. Créez tous les graphiques, y compris Renko, Kagi ou saut de ligne, avec des paramètres entièrement personnalisables. Cela devient encore plus important pour les tests de stratégies automatisés.

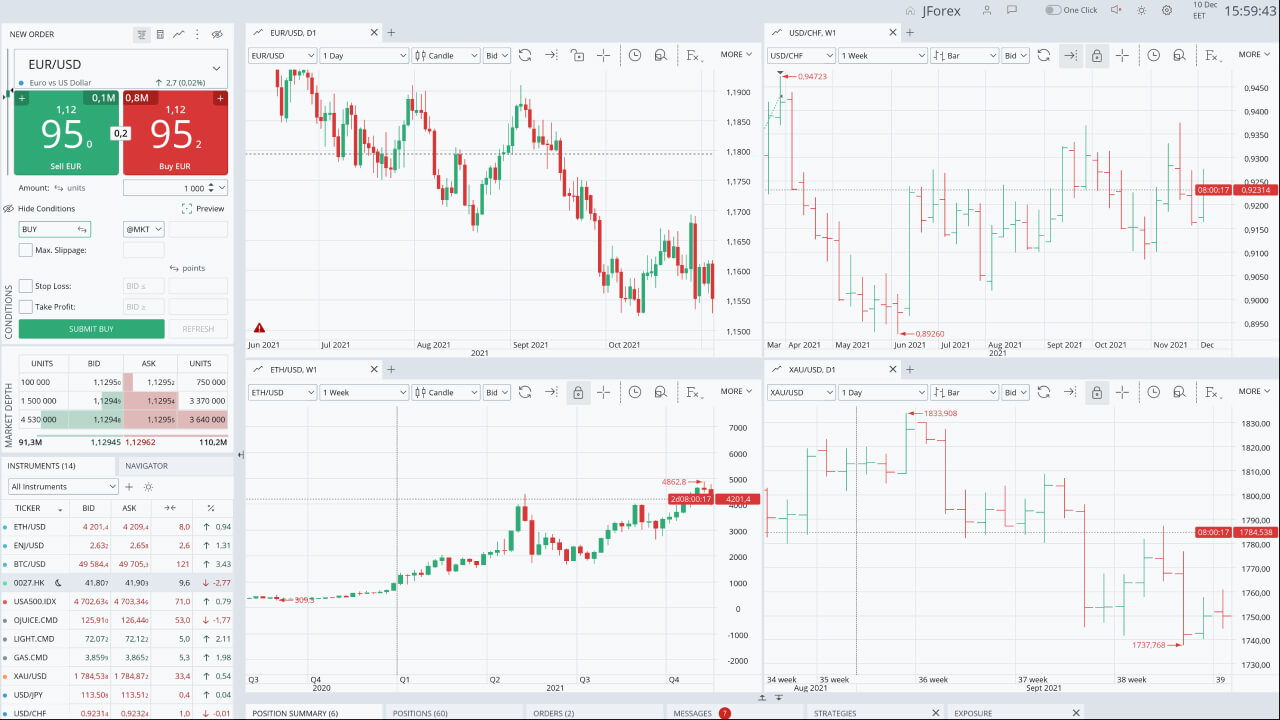

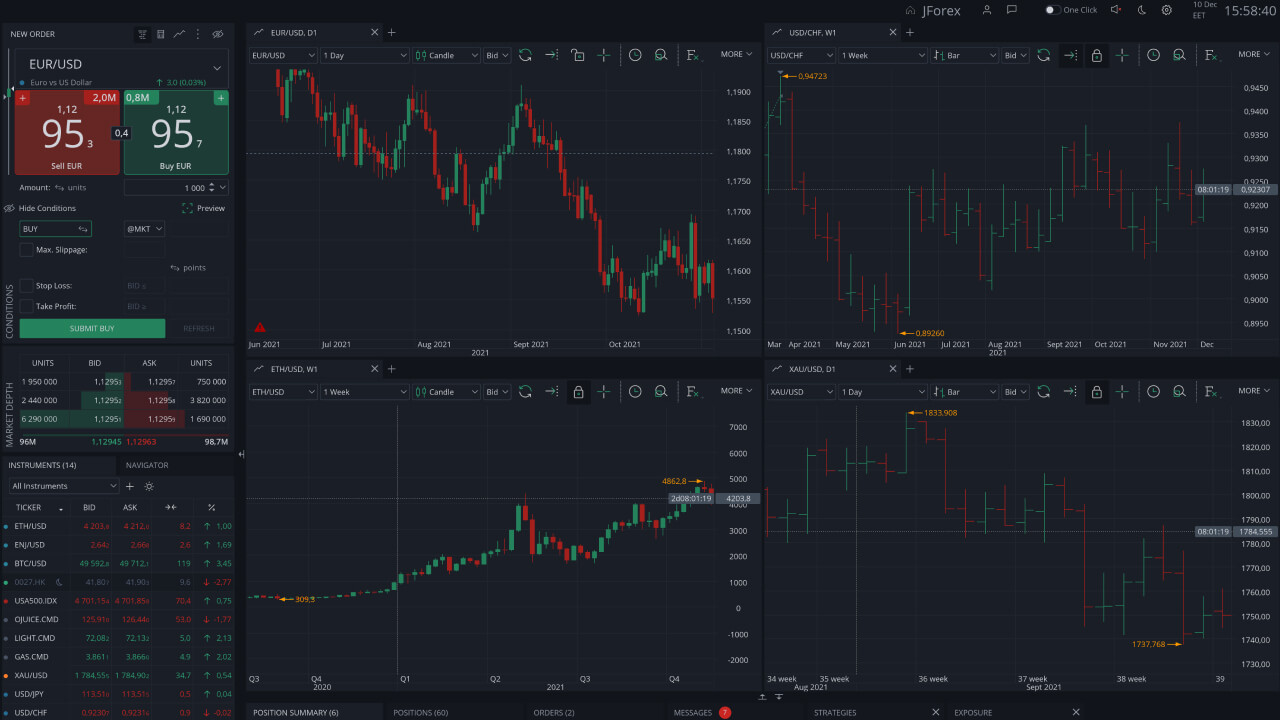

Activez l'option de slippage maximal pour définir la limite d'exécution pour les ordres de type "au marché" ou "stop". Réglez-le sur zéro pour éliminer complètement le slippage.

Cette granularité aide les traders à déterminer l'ampleur des ordres d'achat et de vente à différents prix. Il montre où se concentrent le plus de commandes.

Ouvrez votre plateforme de trading sur n'importe quel ordinateur avec la mise en page et les modèles de graphiques synchronisés.

Voir les données des événements économiques et leur impact directement sur le graphique.

Suivez votre exposition par actifs, instruments ou positions. Construisez vos stratégies de trading plus conservatrices.

Répondez aux changements du marché en surveillant la distance jusqu'à vos niveaux Take Profit & Stop Loss, le prix d'ouverture et le prix actuel du marché - le tout en un seul endroit.

Une grande sélection d'indicateurs et d'outils de dessin

Ajoutez vos instruments Forex et CFD préférés et suivez les hauts et les bas quotidiens.

| Fonctionnalité chez Dukascopy | JFOREX | Apple iOS | Web | Android |

|---|---|---|---|---|

| Contrôle de déviation | ||||

| Placer une DEMANDE/Placer une OFFRE ordres(4) | ||||

| Mode hedging | (1) | |||

| Mode "Position nette" (4) | ||||

| Outils d'analyse technique | (2) | (2) | (2) | |

| Nouvelles de marchés et outils d'analyse | ||||

| Alertes de marché | ||||

| Outils de communication | ||||

| Trading automatisé (éditeur de stratégies) | (3) | |||

| Interface multi-langues | ||||

| Paramètres configurables | ||||

| Définition de la fréquence de mise à jour | ||||

| Ordres Trailing Stop | (1) | |||

| Mode simple clic |

JForex 4 offers traders the opportunity to trade over 1200 instruments across eight asset classes, including forex and CFD. MT4 and MT5 provide access to 108 instruments, including popular currency pairs.

The best trading platform is dependent upon your experience, requirements, and preferences. Dukascopy offers a range of platforms, including MT5 and MT4, as well as the advanced JForex 4, each with distinct advantages for currency trading. MT4 and MT5 allow trading of up to 108 assets, while JForex 4 enables trading of over 1200 instruments. Research and compare features such as charting tools, mobile apps, and automated trading capabilities to find the platform that best suits you.

Online currency trading involves selecting a regulated forex broker, opening a trading account, and depositing funds. Once you have gained familiarity with the basics (pips, leverage, and margin), you can develop a trading strategy (technical or fundamental analysis) and practice with a demo account. When you are ready, you can start with small trades and utilize risk management tools like stop-loss orders to limit potential losses as you navigate the dynamic forex market.

Currency trading can be suitable for beginners, but it requires a solid understanding of the forex market and a disciplined approach. The market's high liquidity and potential for profit attract many new traders; however, the significant risks and volatility mean that thorough education and careful planning are essential. Beginners should start with a demo account to practice trading strategies without financial risk and gradually transition to live trading as they gain experience and confidence.

These are the simple steps to start trading:

If you want to learn currency trading, you need to start by studying the fundamentals. There are plenty of online courses, books, and tutorials out there that will teach you everything you need to know about the forex market, including the basics, technical and fundamental analysis, and trading strategies. Use a demo account offered by Dukascopy Bank to practice what you've learned. Additionally, join online trading communities, follow market news, and consider attending webinars or workshops to stay updated on market trends and deepen your understanding. Review and refine your strategies continuously, based on your experiences and evolving market conditions.

For beginners, major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, might be a good starting point. These pairs tend to be more liquid (meaning easier to buy and sell) and have tighter spreads, which can be helpful when starting out. However, even these major pairs can be volatile, so it is advisable to prioritize education, risk management, and practicing with a demo account before risking real money.