Note: This section contains information in English only.

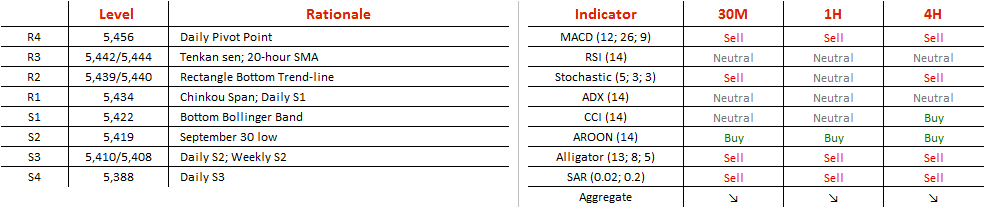

The Australian index concluded its consolidation period with a violation of the 5'439 bottom trend-line of the rectangle it has consistently traded in for the last two weeks. Following a retracement to the broken demand zone, the gauge is on its way to test 5'409/5'407 after battling 5'419, the September 30 low. Adding more ground to our presumption of an extended downtrend, a death cross has been formed above the current index level of 5'429 Australian Dollars. We see the SWFX market betting on the rate to dip with 72% of positions being long, suggesting that the strongly oversold index might require some buying pressures to approach equilibrium. The daily S1 and Chinkou Span confluence at 5'434 would then cap a short-term movement north.

The Australian index concluded its consolidation period with a violation of the 5'439 bottom trend-line of the rectangle it has consistently traded in for the last two weeks. Following a retracement to the broken demand zone, the gauge is on its way to test 5'409/5'407 after battling 5'419, the September 30 low. Adding more ground to our presumption of an extended downtrend, a death cross has been formed above the current index level of 5'429 Australian Dollars. We see the SWFX market betting on the rate to dip with 72% of positions being long, suggesting that the strongly oversold index might require some buying pressures to approach equilibrium. The daily S1 and Chinkou Span confluence at 5'434 would then cap a short-term movement north.

Thu, 13 Oct 2016 07:14:38 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.