Note: This section contains information in English only.

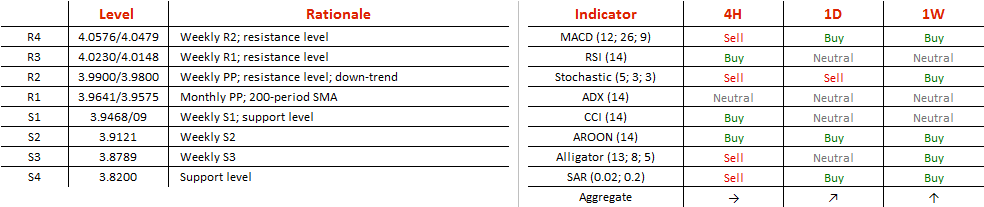

Considering that USD/PLN is guided by the 15-month up-trend support line, which is currently at 3.80, the long-term prospects are bullish. However, in the short run the pair is weak, since at the moment it is forming a descending triangle, a pattern that implies growing supply and hence a sell-off. The key support level at 3.94, and in case it is breached, the rate will be set to fall, although the dip is to be limited by 3.82/3.80. In the meantime, bearish signals are scarce, meaning 3.94 might hold. For one, a majority of technical indicators is giving ‘buy' signals. At the same time, the US Dollar is noticeably oversold (66% of positions are short), which increases the chance of Greenback's appreciation.

Considering that USD/PLN is guided by the 15-month up-trend support line, which is currently at 3.80, the long-term prospects are bullish. However, in the short run the pair is weak, since at the moment it is forming a descending triangle, a pattern that implies growing supply and hence a sell-off. The key support level at 3.94, and in case it is breached, the rate will be set to fall, although the dip is to be limited by 3.82/3.80. In the meantime, bearish signals are scarce, meaning 3.94 might hold. For one, a majority of technical indicators is giving ‘buy' signals. At the same time, the US Dollar is noticeably oversold (66% of positions are short), which increases the chance of Greenback's appreciation.

Thu, 28 Jul 2016 07:47:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.