Note: This section contains information in English only.

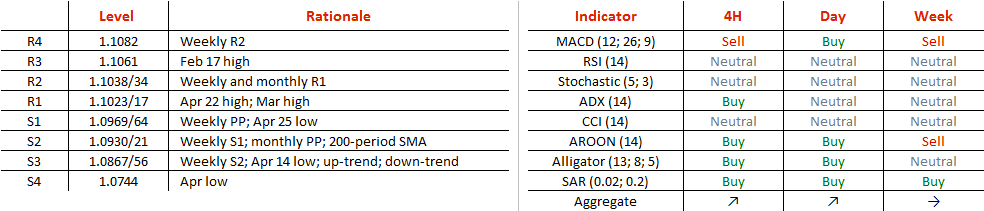

Extension of the Euro's recovery from 1.0870 is unlikely. Even though the four-hour and daily technical indicators are mostly pointing north, the currency pair has formed a double top, a pattern that suggests a heightened risk of a sell-off. Still, the bearish scenario will not be confirmed as long as support at 1.0969/64 remains intact. Once the neck-line is broken, 1.0930/21 (monthly PP and 200-period SMA) are to become the next point of destination. An additional demand area is at 1.0870/60, created for the most part by the nine-month up-trend. As for the SWFX traders, they appear to be undecided with respect to the Euro's prospects: 45% of open positions are long and 55% are short.

Extension of the Euro's recovery from 1.0870 is unlikely. Even though the four-hour and daily technical indicators are mostly pointing north, the currency pair has formed a double top, a pattern that suggests a heightened risk of a sell-off. Still, the bearish scenario will not be confirmed as long as support at 1.0969/64 remains intact. Once the neck-line is broken, 1.0930/21 (monthly PP and 200-period SMA) are to become the next point of destination. An additional demand area is at 1.0870/60, created for the most part by the nine-month up-trend. As for the SWFX traders, they appear to be undecided with respect to the Euro's prospects: 45% of open positions are long and 55% are short.

Thu, 28 Apr 2016 06:59:20 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.