Note: This section contains information in English only.

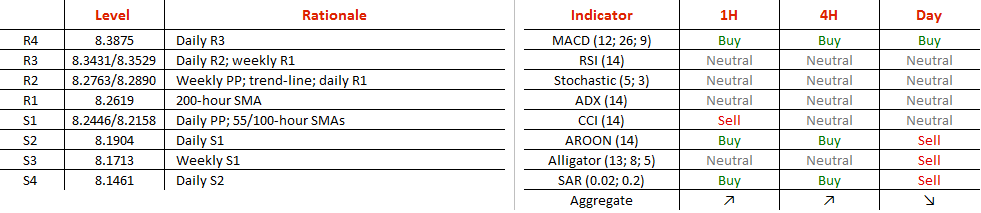

Although the US Dollar is making attempts to rebound and prevent a new leg down against the Norwegian Krone, we suspect this currency pair will not avoid a selloff. First of all, the spot is placed very close to the 200-hour SMA, which is followed by the weekly pivot point. They both are guarding the upper edge of the pattern. Moreover, the daily technical indicators are bearish on the Greenback. The only upside risk is the 55-hour SMA, currently at 8.2362, which seems to be the only support able to contain the bearish pressure. However, in case there is a surprising spike above 8.29, then it will be difficult to rule out further gains in the direction of the February high at 8.7615 in the long run.

Although the US Dollar is making attempts to rebound and prevent a new leg down against the Norwegian Krone, we suspect this currency pair will not avoid a selloff. First of all, the spot is placed very close to the 200-hour SMA, which is followed by the weekly pivot point. They both are guarding the upper edge of the pattern. Moreover, the daily technical indicators are bearish on the Greenback. The only upside risk is the 55-hour SMA, currently at 8.2362, which seems to be the only support able to contain the bearish pressure. However, in case there is a surprising spike above 8.29, then it will be difficult to rule out further gains in the direction of the February high at 8.7615 in the long run.

Fri, 15 Apr 2016 13:49:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.