Note: This section contains information in English only.

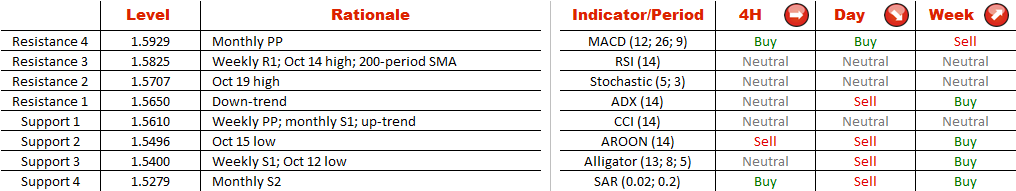

EUR/AUD is about to break out of the symmetrical triangle, which should lead to increased volatility in the near term. If the price jumps above the upper trend-line at 1.5650, we will expect an extension of the rally towards 1.5825, where the weekly R1 merges with the last week's high and 200-period SMA. Additional resistances are at 1.5929 (monthly PP) and at 1.6250 (monthly R1 and Sep high). Alternatively, if the value of the Euro falls below A$1.56, the sell-off is likely to go on until the rate falls down to 1.54. At the same time, a close beneath 1.5279 will imply a decline to the Aug low at 1.50. Meanwhile, there is no consensus in the market: 53% of open positions are long and 47% are short.

EUR/AUD is about to break out of the symmetrical triangle, which should lead to increased volatility in the near term. If the price jumps above the upper trend-line at 1.5650, we will expect an extension of the rally towards 1.5825, where the weekly R1 merges with the last week's high and 200-period SMA. Additional resistances are at 1.5929 (monthly PP) and at 1.6250 (monthly R1 and Sep high). Alternatively, if the value of the Euro falls below A$1.56, the sell-off is likely to go on until the rate falls down to 1.54. At the same time, a close beneath 1.5279 will imply a decline to the Aug low at 1.50. Meanwhile, there is no consensus in the market: 53% of open positions are long and 47% are short.

Wed, 21 Oct 2015 06:39:27 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.