On the other hand, if support at the mark of 1,151 fails to underpin the price and allows the exchange rate to fall, there is likely to be a sell-off through the weekly pivot point down to 1,132 dollars, the current location of the 200-hour SMA. The sentiment among the SWFX traders is only slightly bullish: 57% of positions are long and 43% are short.

Note: This section contains information in English only.

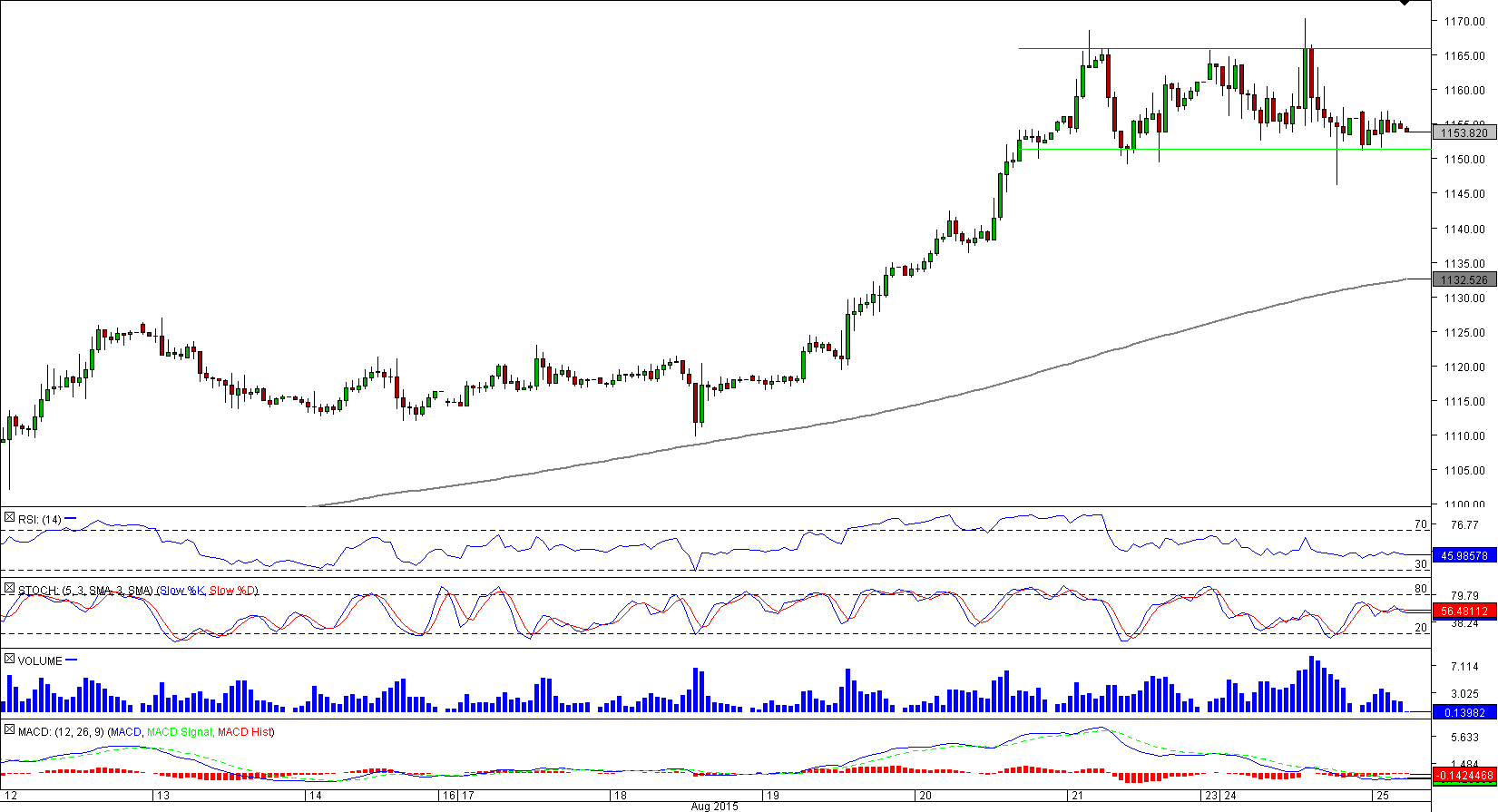

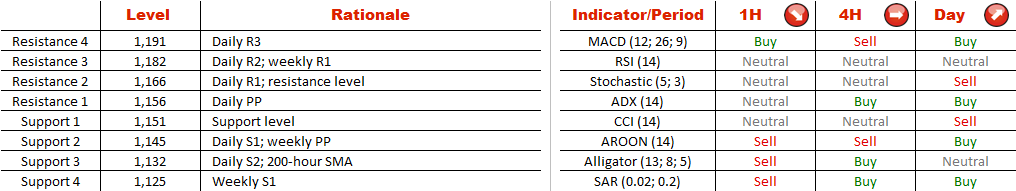

Considering that a rectangle is a continuation pattern and before the consolidation started the trend had been bullish, the base scenario is a break-out through 1,166. In this case the target will be a combination of the daily R2 and weekly R1 at 1,182. Beyond this lies the June high and weekly R2 at 1,206.

Considering that a rectangle is a continuation pattern and before the consolidation started the trend had been bullish, the base scenario is a break-out through 1,166. In this case the target will be a combination of the daily R2 and weekly R1 at 1,182. Beyond this lies the June high and weekly R2 at 1,206.

On the other hand, if support at the mark of 1,151 fails to underpin the price and allows the exchange rate to fall, there is likely to be a sell-off through the weekly pivot point down to 1,132 dollars, the current location of the 200-hour SMA. The sentiment among the SWFX traders is only slightly bullish: 57% of positions are long and 43% are short.

Tue, 25 Aug 2015 06:50:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

On the other hand, if support at the mark of 1,151 fails to underpin the price and allows the exchange rate to fall, there is likely to be a sell-off through the weekly pivot point down to 1,132 dollars, the current location of the 200-hour SMA. The sentiment among the SWFX traders is only slightly bullish: 57% of positions are long and 43% are short.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.