Note: This section contains information in English only.

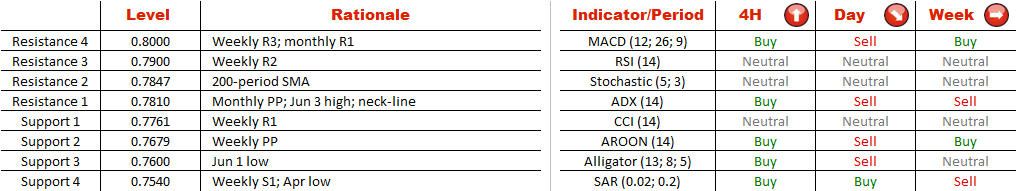

AUD/USD appears to have bottomed out at 0.76, and there is an increased possibility of a strong rally over the next several weeks. Once a cluster of resistances just above 0.78 is broken, the Aussie will be in a good position to surge towards May high, despite there being the 200-period SMA. A more conservative target would be the monthly R1. However, if the neck-line stays intact, the price is likely to retreat back to the Jun 1 low, and potentially it could form yet another bottom. Otherwise, we will look at 0.7534 (weekly S1 and Apr low) as the next objective. In the meantime, a substantial majority of the SWFX traders (73% of them) is long the Australian Dollar.

AUD/USD appears to have bottomed out at 0.76, and there is an increased possibility of a strong rally over the next several weeks. Once a cluster of resistances just above 0.78 is broken, the Aussie will be in a good position to surge towards May high, despite there being the 200-period SMA. A more conservative target would be the monthly R1. However, if the neck-line stays intact, the price is likely to retreat back to the Jun 1 low, and potentially it could form yet another bottom. Otherwise, we will look at 0.7534 (weekly S1 and Apr low) as the next objective. In the meantime, a substantial majority of the SWFX traders (73% of them) is long the Australian Dollar.

Thu, 11 Jun 2015 05:15:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.