Note: This section contains information in English only.

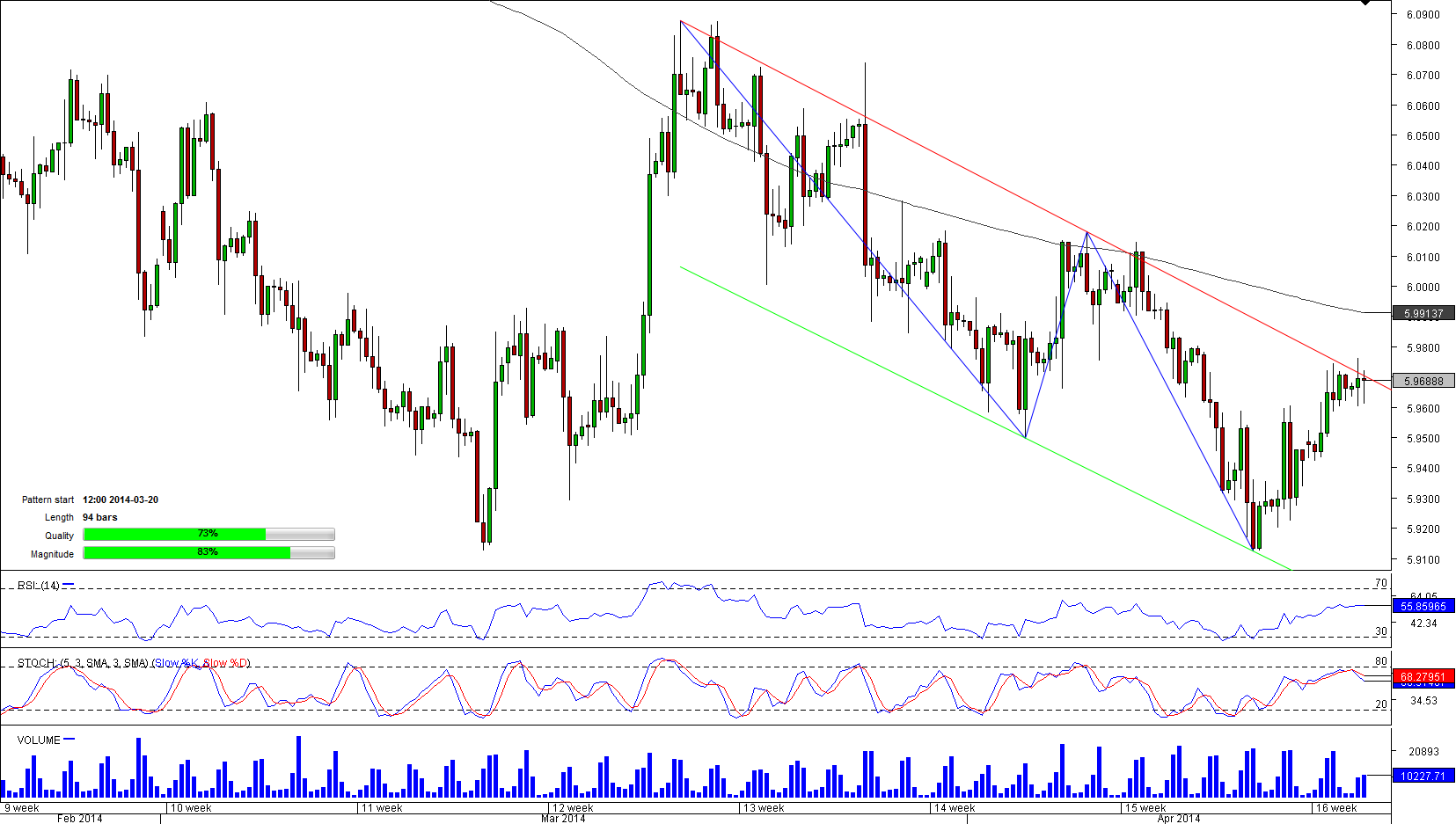

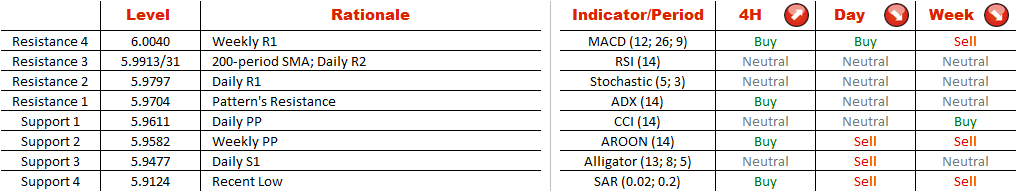

After hitting 6.3149 on February 4, that was the highest since September 2010, the Norwegian Krone began its appreciation versus the U.S. Dollar. However, after touching a low at 5.9124 just five days ago, the pair bounced back to resistance line of the channel down pattern that was formed on February 20. The short-term outlook is bullish, as indicators on a 4H chart and markets sentiment (73%) are pointing at a move closer to the 200-period SMA. In a longer-term, however, the pair is projected to continue its depreciation. Therefore, a move back to the recent low is expected. But first, traders will have to break the weekly and daily pivot around 5.96 area.

After hitting 6.3149 on February 4, that was the highest since September 2010, the Norwegian Krone began its appreciation versus the U.S. Dollar. However, after touching a low at 5.9124 just five days ago, the pair bounced back to resistance line of the channel down pattern that was formed on February 20. The short-term outlook is bullish, as indicators on a 4H chart and markets sentiment (73%) are pointing at a move closer to the 200-period SMA. In a longer-term, however, the pair is projected to continue its depreciation. Therefore, a move back to the recent low is expected. But first, traders will have to break the weekly and daily pivot around 5.96 area.

Tue, 15 Apr 2014 11:25:51 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.