Note: This section contains information in English only.

Fri, 28 Mar 2014 13:34:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

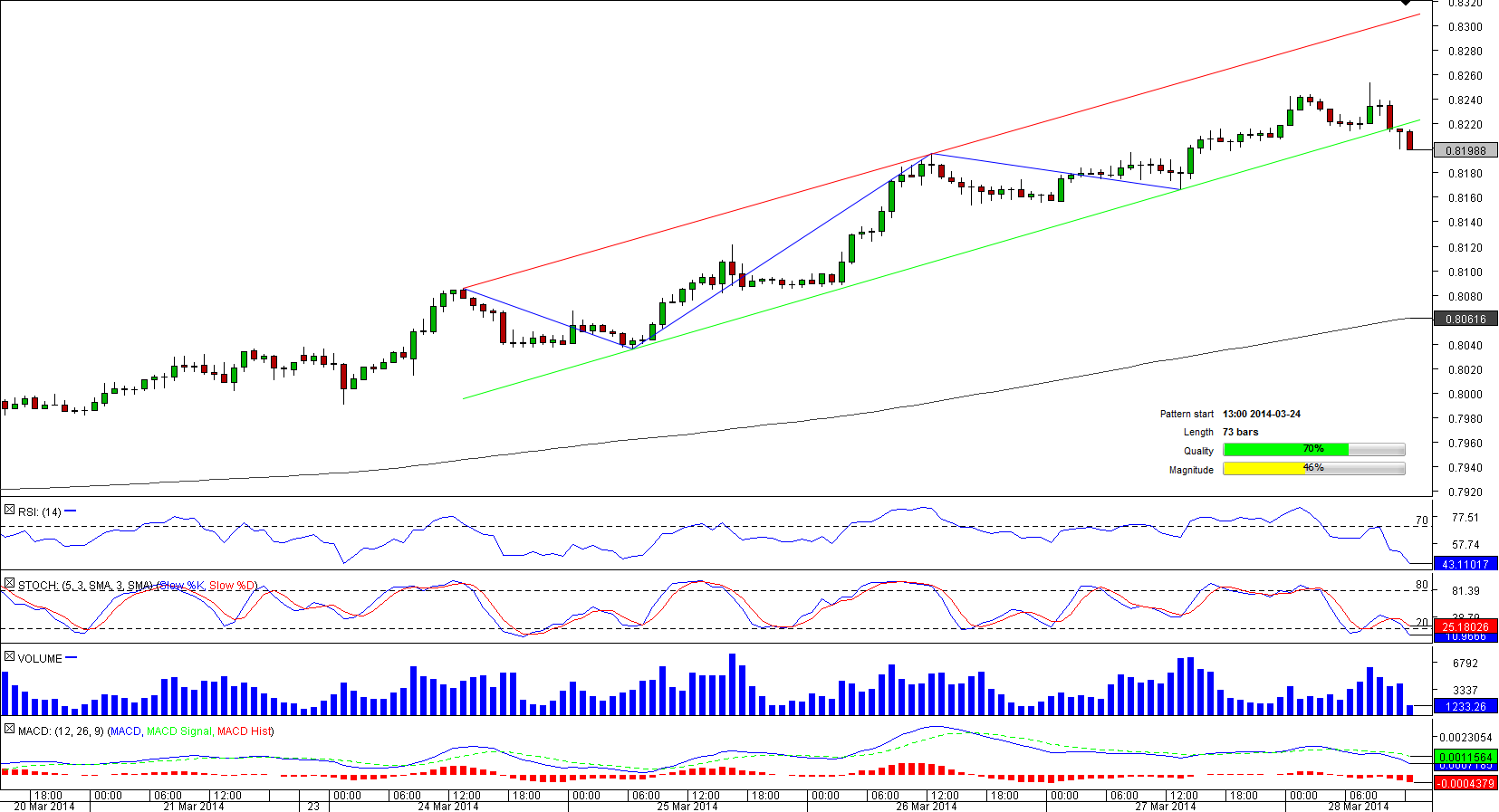

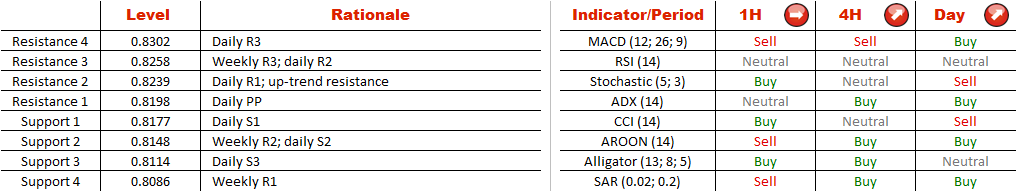

Although at first there were good reasons to believe that AUD/CHF is going to continue respecting two parallel rising trend-line, eventually the rally turned out to be unsustainable. Still, the pattern may be used to estimate potential targets after a break-out. The first one is likely to be the weekly R2 level at 0.8148, but the exchange rate could drop even lower, down to the weekly R1 at 0.8114. However, neither the four-hour nor the daily technical indicators are in favour of such a scenario, most of them are currently giving ‘buy' signals. At the same time, the sentiment among the SWFX traders towards AUD/CHF is explicitly bullish, as 71% of open positions are long.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.