Note: This section contains information in English only.

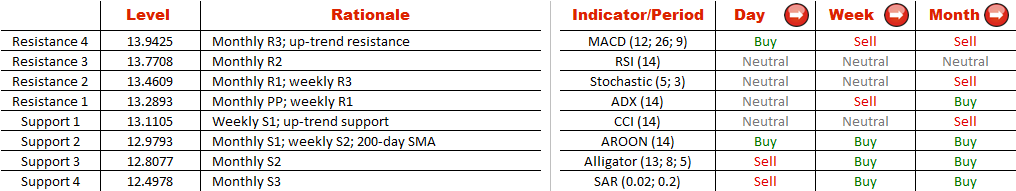

Once the currency pair completed a consolidation phase last year in October, HKD/JPY resumed the recovery. Later on this bullish tendency developed into an upward-sloping channel with the main resistance at 13.9725, where it is reinforced by the monthly R3 level, and the support at 13.1105, which is reinforced by an additional demand area at 12.9793, where the monthly S1 merges with the 200-day SMA.

Once the currency pair completed a consolidation phase last year in October, HKD/JPY resumed the recovery. Later on this bullish tendency developed into an upward-sloping channel with the main resistance at 13.9725, where it is reinforced by the monthly R3 level, and the support at 13.1105, which is reinforced by an additional demand area at 12.9793, where the monthly S1 merges with the 200-day SMA.

Mon, 24 Feb 2014 08:55:02 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

And even though at the moment the technical indicators on all time-frames are mixed and the sentiment is rather bearish (71% of open positions are short), in the long-term the Hong Kong Dollar is more likely to outperform than the Japanese Yen.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.