Note: This section contains information in English only.

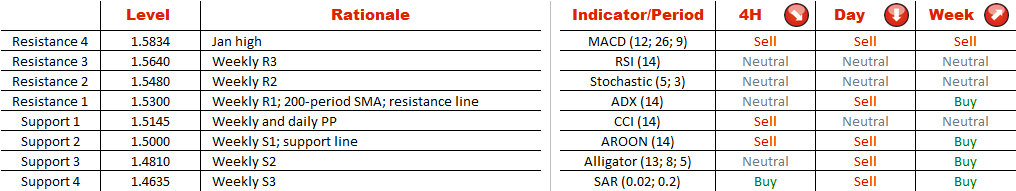

Although at first it looked as if EUR/AUD was going to rise sharply as a result of the double bottom formation (Jan 24 - Feb 12), in the end the currency pair proved to be unable to breach the neck-line at 1.53. This resistance consists of the highs and lows seen the last three months, weekly R1 level and the 200-period SMA, making appearance of a rally highly unlikely. Moreover, most of the four-hour and daily technical indicators are bearish at the moment, suggesting that the price is expected to decline, possibly down to the support at 1.50, where the recent lows merge with the weekly S1 level. Meanwhile, the sentiment of the SWFX market towards EUR/AUD is perfectly neutral.

Although at first it looked as if EUR/AUD was going to rise sharply as a result of the double bottom formation (Jan 24 - Feb 12), in the end the currency pair proved to be unable to breach the neck-line at 1.53. This resistance consists of the highs and lows seen the last three months, weekly R1 level and the 200-period SMA, making appearance of a rally highly unlikely. Moreover, most of the four-hour and daily technical indicators are bearish at the moment, suggesting that the price is expected to decline, possibly down to the support at 1.50, where the recent lows merge with the weekly S1 level. Meanwhile, the sentiment of the SWFX market towards EUR/AUD is perfectly neutral.

Tue, 18 Feb 2014 11:56:53 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.