Note: This section contains information in English only.

Mon, 17 Feb 2014 12:25:19 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

Soon after bottoming out late January around 0.8660, the Australian Dollar managed to recuperate by gaining a foothold above the long-term moving average and at the same time formed a neat bullish channel.

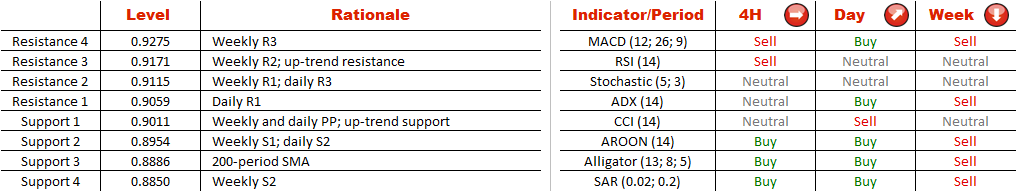

And while the daily technical indicators, in conjunction with the strongly bullish sentiment towards AUD/USD (65% of positions are long), propose that the recovery will continue, there is a risk that the trading range will narrow, leading to emergence of the rising wedge pattern, which means a high probability of a decline. This course of events is also implied by the weekly studies, as five out of eight are presently giving ‘sell' signals.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.