Note: This section contains information in English only.

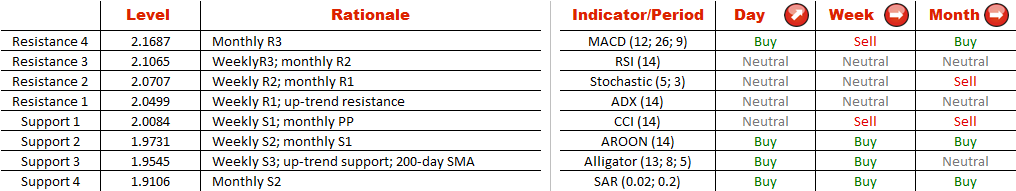

Several months after bottoming out at 1.77 and confirming the 200-day SMA as the new support, GBP/NZD was able to form a bullish channel, which is now more than 100 candlesticks in length. And while the long-term outlook is therefore positive, in the short run the British Pound is set to decline in value relative to the kiwi, being that the currency pair has just tested the upper rising trend-line at 2.05 and, as a result, is undergoing a downward correction, which could extend down to 1.9545, where the lower edge of the figure merges with the weekly S3 and the 200-day SMA. Meanwhile, the SWFX market is undecided with respect to GBP/NZD's future—54% of positions are long and 46% are short.

Several months after bottoming out at 1.77 and confirming the 200-day SMA as the new support, GBP/NZD was able to form a bullish channel, which is now more than 100 candlesticks in length. And while the long-term outlook is therefore positive, in the short run the British Pound is set to decline in value relative to the kiwi, being that the currency pair has just tested the upper rising trend-line at 2.05 and, as a result, is undergoing a downward correction, which could extend down to 1.9545, where the lower edge of the figure merges with the weekly S3 and the 200-day SMA. Meanwhile, the SWFX market is undecided with respect to GBP/NZD's future—54% of positions are long and 46% are short.

Tue, 04 Feb 2014 13:22:29 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.