Note: This section contains information in English only.

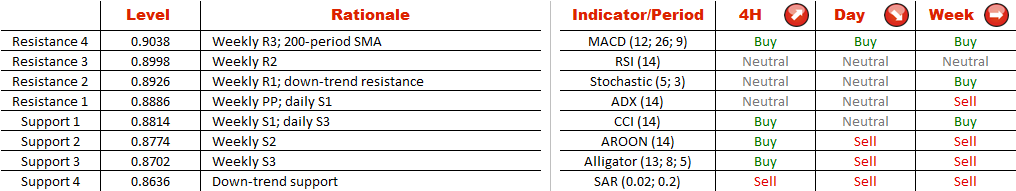

A decline that we have been observing for the past two months is a continuation (after a prolonged bullish correction) of the down-trend started back in April, when the Australian Dollar was changing hands around the level of 1.05 U.S. dollars. Consequently, there is an increased chance that AUD/USD will go even deeper from here. However, we must also note that the support at 0.885 is the last year's August low and may prove to be impenetrable, as it did in December on several occasions. The bearish bias will therefore will be invalidated should the exchange rate cross the down-trend resistance line at 0.8926 and the weekly R3 at 0.9038 reinforced by the 200-period SMA.

A decline that we have been observing for the past two months is a continuation (after a prolonged bullish correction) of the down-trend started back in April, when the Australian Dollar was changing hands around the level of 1.05 U.S. dollars. Consequently, there is an increased chance that AUD/USD will go even deeper from here. However, we must also note that the support at 0.885 is the last year's August low and may prove to be impenetrable, as it did in December on several occasions. The bearish bias will therefore will be invalidated should the exchange rate cross the down-trend resistance line at 0.8926 and the weekly R3 at 0.9038 reinforced by the 200-period SMA.

Thu, 02 Jan 2014 12:33:40 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.