Note: This section contains information in English only.

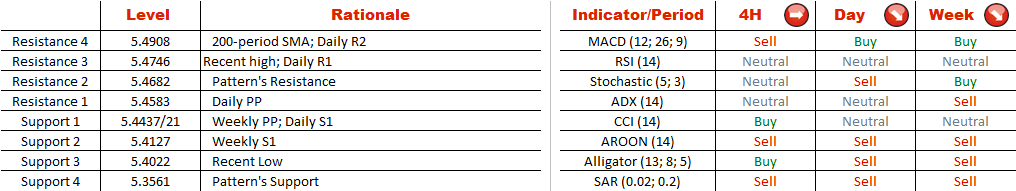

After peaking at 5.609 on November 7, the pair has began a movement to the south. There has been an attempt to break the resistance line at 5.4746, however, bulls were not strong enough. The outlook for the pair is bearish, as technical indicators are sending ‘sell' signals, suggesting the latest rally is running out of steam. At the moment of writing the pair was trading at 5.4462, approaching a weekly pivot and daily S1. The majority of pending orders across the board at placed to sell the pair, meaning bears will get additional support from orders. In this case, the potential take profit could be placed at 5.4127, more than 340 pips from the market price. The usual daily volatility is around 100 pips.

After peaking at 5.609 on November 7, the pair has began a movement to the south. There has been an attempt to break the resistance line at 5.4746, however, bulls were not strong enough. The outlook for the pair is bearish, as technical indicators are sending ‘sell' signals, suggesting the latest rally is running out of steam. At the moment of writing the pair was trading at 5.4462, approaching a weekly pivot and daily S1. The majority of pending orders across the board at placed to sell the pair, meaning bears will get additional support from orders. In this case, the potential take profit could be placed at 5.4127, more than 340 pips from the market price. The usual daily volatility is around 100 pips.

Mon, 23 Dec 2013 14:17:50 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.