Note: This section contains information in English only.

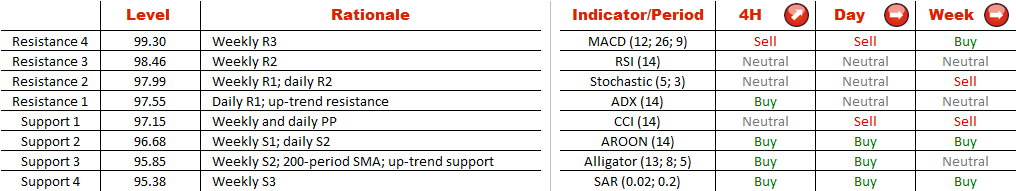

Trading range of CAD/JPY started to narrow in mid-October, following an unsuccessful attempt of the currency pair to surpass 95.90 and a subsequent recovery from 92.90 (it may become the final target in case of a break-out to the downside). At the moment, however, the currency pair is hovering in proximity to the upper trend-line that creates strong resistance at 97.55. Accordingly, there is a high possibility of a sell-off from here down to the lower edge of the pattern at 95.85, where it merges with the 200-period SMA and the weekly S2 level. This idea is also shared by he majority of SWFX traders, 71% of whom are currently holding short positions on CAD/JPY.

Trading range of CAD/JPY started to narrow in mid-October, following an unsuccessful attempt of the currency pair to surpass 95.90 and a subsequent recovery from 92.90 (it may become the final target in case of a break-out to the downside). At the moment, however, the currency pair is hovering in proximity to the upper trend-line that creates strong resistance at 97.55. Accordingly, there is a high possibility of a sell-off from here down to the lower edge of the pattern at 95.85, where it merges with the 200-period SMA and the weekly S2 level. This idea is also shared by he majority of SWFX traders, 71% of whom are currently holding short positions on CAD/JPY.

Tue, 17 Dec 2013 12:39:42 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.