Note: This section contains information in English only.

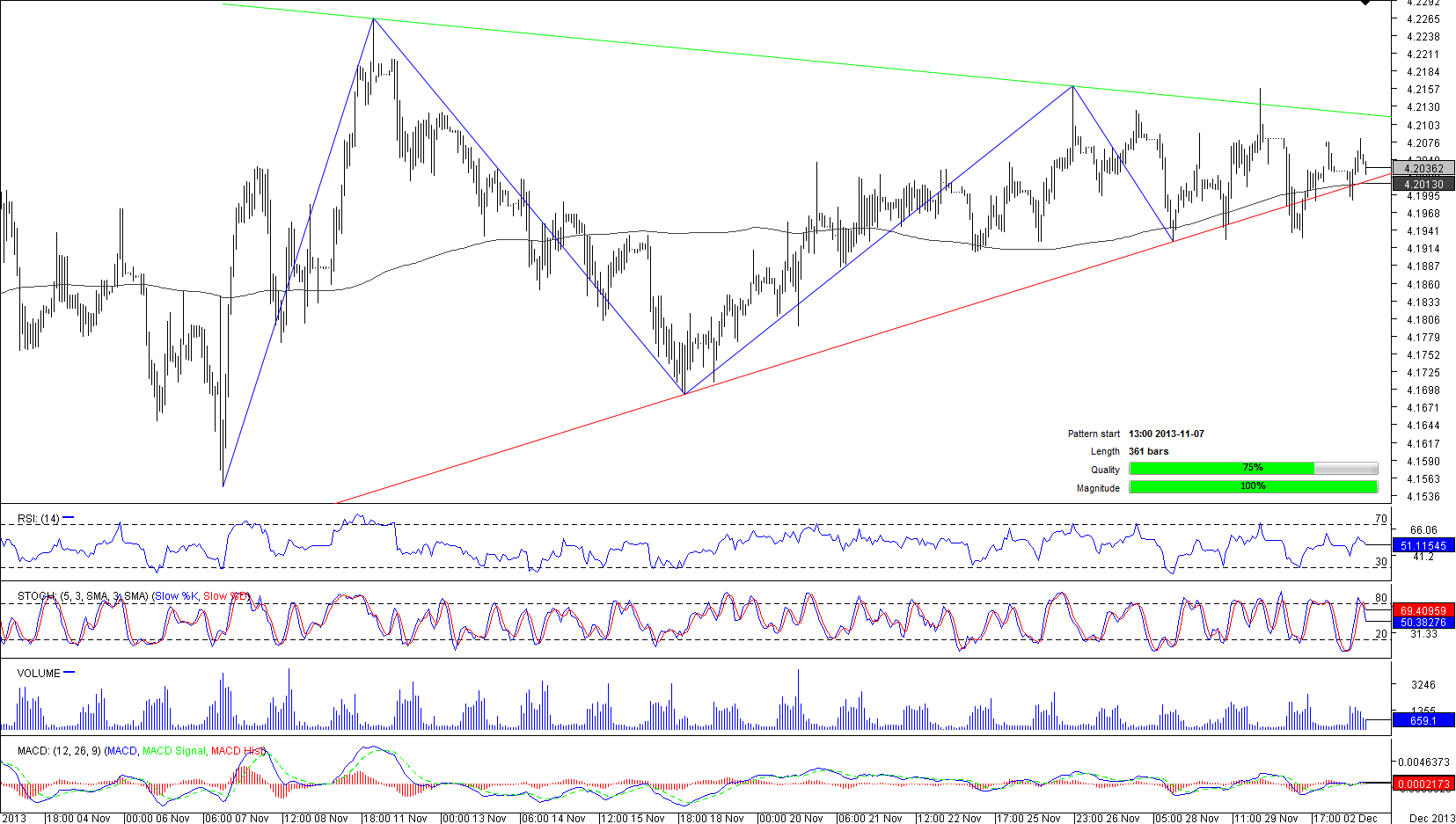

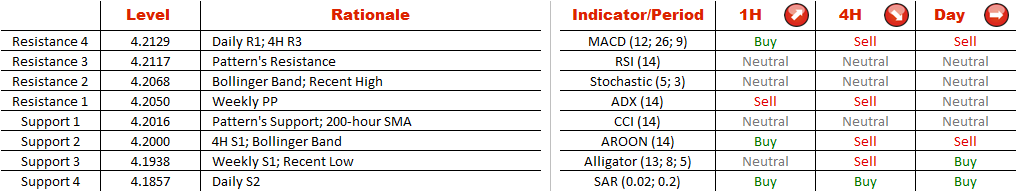

EUR/PLN is likely to be highly volatile in the nearest future, not later than December 6 to be more precise, as the pair is bounded between two sloping trend lines that will converge on Friday. The trading range is narrowing rapidly and at the moment of writing the pair was fluctuating in a 99 pips range, compared with 716 on November 7, when the pattern was formed. Even though bears are facing strong support line at 4.2016, represented by lower trend line and 200-hour SMA, a dip below this level can be expected, as 71% of traders are holding short positions. Together with bearish technical indicators on a 4H chart, short traders can prepare to enter the market soon.

EUR/PLN is likely to be highly volatile in the nearest future, not later than December 6 to be more precise, as the pair is bounded between two sloping trend lines that will converge on Friday. The trading range is narrowing rapidly and at the moment of writing the pair was fluctuating in a 99 pips range, compared with 716 on November 7, when the pattern was formed. Even though bears are facing strong support line at 4.2016, represented by lower trend line and 200-hour SMA, a dip below this level can be expected, as 71% of traders are holding short positions. Together with bearish technical indicators on a 4H chart, short traders can prepare to enter the market soon.

Tue, 03 Dec 2013 15:22:40 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.