Note: This section contains information in English only.

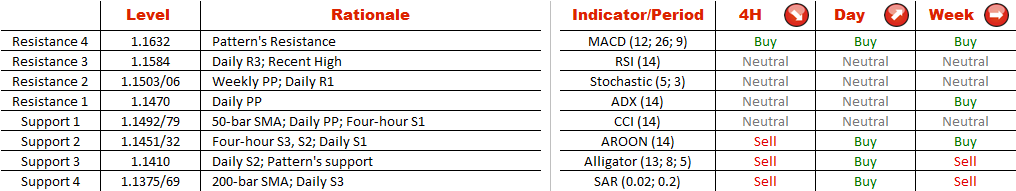

During the last five trading days Aussie fell 0.31%, while Kiwi advanced 0.45% versus other major currencies. The Aussie– Kiwi cross is still trading in channel up pattern's boundaries, however, it is approaching a key level around 1.14. A move below it would put 1.1375 on the map, and according to technicals on a 4H chart, the short term scenario is bearish. At the same time, almost 74% of traders are holding long positions on the pair, suggesting a retest of the support line is unlikely. Moreover, technical on a daily chart are pointing to a direction to the north, hence, long traders may focus on a recent high and a daily resistance at 1.1584.

During the last five trading days Aussie fell 0.31%, while Kiwi advanced 0.45% versus other major currencies. The Aussie– Kiwi cross is still trading in channel up pattern's boundaries, however, it is approaching a key level around 1.14. A move below it would put 1.1375 on the map, and according to technicals on a 4H chart, the short term scenario is bearish. At the same time, almost 74% of traders are holding long positions on the pair, suggesting a retest of the support line is unlikely. Moreover, technical on a daily chart are pointing to a direction to the north, hence, long traders may focus on a recent high and a daily resistance at 1.1584.

Fri, 01 Nov 2013 13:57:20 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.