The MACD and the CCI indicators point at a bearish market outbreak at 1H and 4H time horizons. The current market sentiment is around 55/45 in favor for the bears as well. Short traders could focus on the support level at 1.2690. If the pair breaches this level, next possible targets could be at 1.2661, 1,2616 and at SMA200 at around 1.2585.

Note: This section contains information in English only.

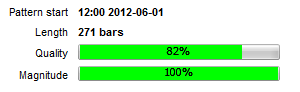

EUR/USD is continuing its recovery after hitting almost a two year low on the 1st of June and has formed a Rising Wedge pattern on the 1H chart. The pattern has 82% quality and 100% magnitude in the 271-bar period.

EUR/USD is continuing its recovery after hitting almost a two year low on the 1st of June and has formed a Rising Wedge pattern on the 1H chart. The pattern has 82% quality and 100% magnitude in the 271-bar period.

The MACD and the CCI indicators point at a bearish market outbreak at 1H and 4H time horizons. The current market sentiment is around 55/45 in favor for the bears as well. Short traders could focus on the support level at 1.2690. If the pair breaches this level, next possible targets could be at 1.2661, 1,2616 and at SMA200 at around 1.2585.

Wed, 20 Jun 2012 14:29:55 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair bounced from 1.2287 and after testing resistance levels at 1.2668 and 1.2747 it has slowed down at 1.270 where the pair is currently trading. Technical indicators on point at a bull market outbreak on 1D time horizon. Long traders could focus on a resistance level at 1.2719. If this level is breached, next targets could be at 1.2730 and at a recent high at 1.2747.

The MACD and the CCI indicators point at a bearish market outbreak at 1H and 4H time horizons. The current market sentiment is around 55/45 in favor for the bears as well. Short traders could focus on the support level at 1.2690. If the pair breaches this level, next possible targets could be at 1.2661, 1,2616 and at SMA200 at around 1.2585.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.