© Dukascopy

"A European sovereign debt default may well sink the United States back into recession. However, if we navigate the storm through the second half of 2012, it appears that danger will recede rapidly in 2013"

- San Francisco Fed Economic Letter (based on Reuters)

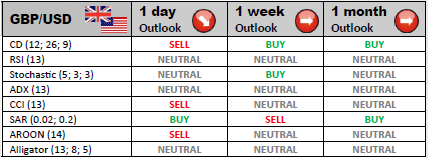

Industry outlook

Resistances at 1.6078 and 1.6139 should be able to negate advancement of the price, while the cable is expected to step lower to 1.5833, 55 day ma. Below this level GBP/USD is likely to target 1.5632 en route to 1.5272.

Traders' sentiment

The minority, being 40.04% of the market, is in favour of the British pound. Consequently, 59.96% of GBP/USD market participants anticipate the American dollar to gain in value relatively to the sterling.

Long position opened

In order to yield on highly volatile U.K. pound, investors should pay close attention to the identified resistance levels for the pair at 1.6032, 1.6167 and 1.6378.

Short position opened

A part of the brokers will close their short positions near the initial support level at 1.5821. In case of downtrend continuation, the pair might bounce off the S2 at 1.5745 or S3 at 1.5534.

© Dukascopy