© Dukascopy

"There is no reason that Japan should be regarded as a safe haven"

- Takehiko Nakao, Japanese Vice Finance Minister (based on Marketwatch)

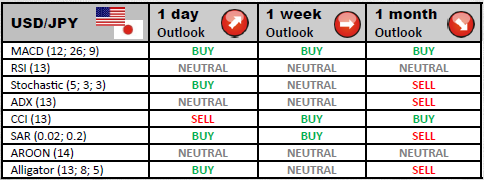

Industry outlook

Indicators suggest further advancement of the pair while it is supported by strong levels at 76.82/63 and 76.22. On the way toward 80.31 USD/JPY will encounter resistances at 78.27, 79.10, 79.41/46, 79.57 and overcome them.

Traders' sentiment

The amount of short positions continue to outnumber long ones in USD/JPY market. 43.2% of traders are bullish on the currency pair, while the largest part (56.8%) deems the price to be bearish and inclined to drop in the future.

Long position opened

Investors should pay attention to the identified with the help of the standard pivot point method resistance zones, as they might be useful during intraday trading. The initial resistance level is at the level of 77.96, whereas R2 and R3 are situated at 78.22 and 78.65 accordingly.

Short position opened

Major dealers are planning to partially close their short positions if the pair touches upon the first support level at 77.27. However, if the bearish impetus proves to be strong enough, some of the positions could be squared off at S2 of 76.84 and at S3 of 76.58.

© Dukascopy